Knowledge Centre

Why Household Debt Will Not Kill The Economy

March 2023

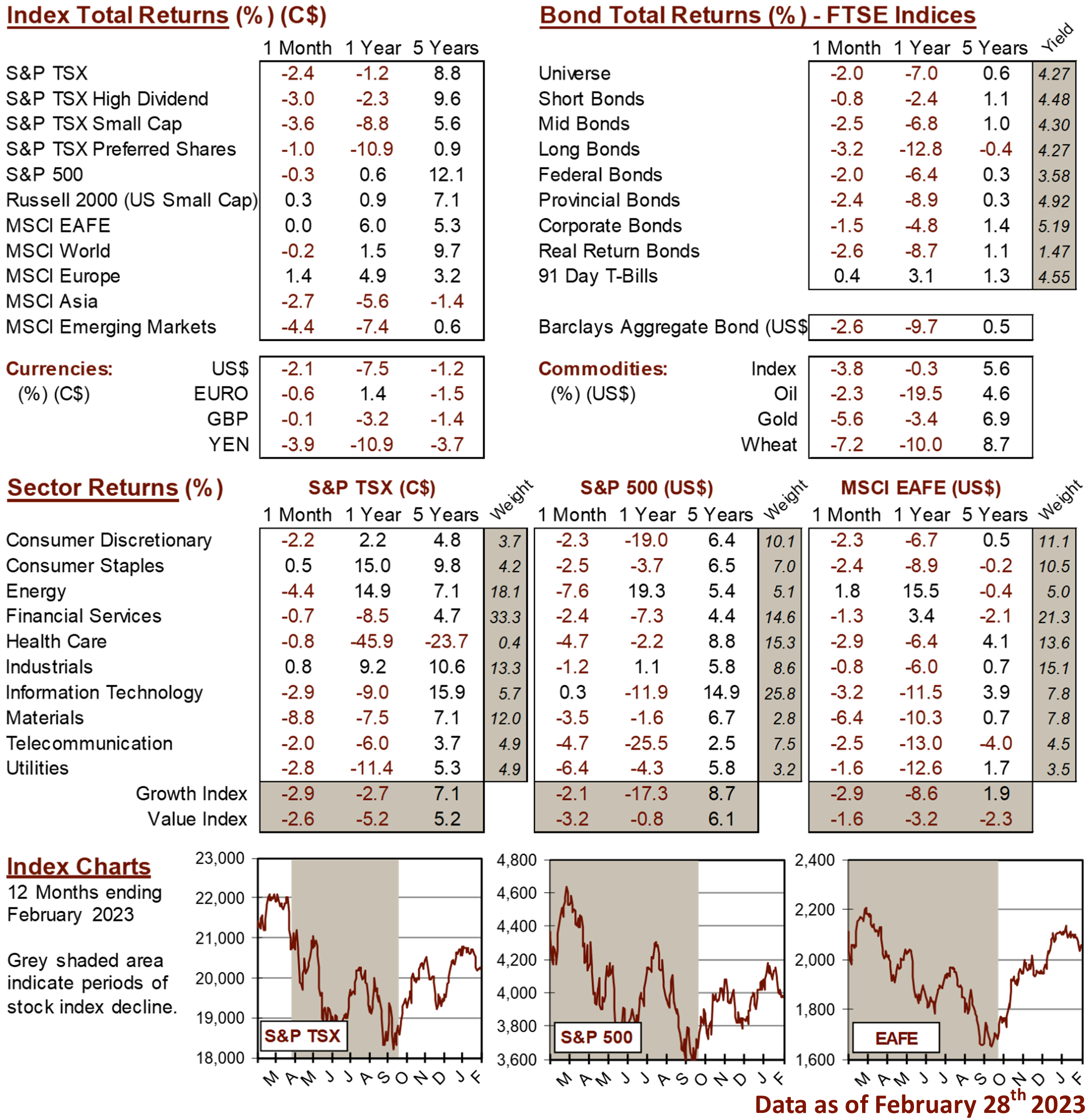

While concerns over the cost of rising interest rates and their impact on capital market expectations is certainly valid, history has shown that for Canadians in particular, it’s not the nail in the coffin as far as recessions go. In June of 2022, inflation accelerated to over 8%, the highest since January 1983, and its impact on markets became painfully clear with the S&P/TSX closing the year down 5.8%. Along with other Central Banks around the globe, The Bank of Canada (BOC) had to trigger multiple rate increases to keep pace with soaring prices. This approach has been effective. Inflation numbers have come down materially as Canada’s annual inflation rate fell to 5.9% in January 2023, the lowest since February 2022 and below market expectations of 6.1%. The relief has not been universal as the cost of food in Canada rose by double digits in January 2023, the highest since 1980.

Despite the negative headlines the Canadian economy was remarkable for most of 2022 with stronger than expected GDP growth in the first and second quarters along with unemployment numbers at historical lows. A uniquely Canadian trait is that we have a reputation for making our mortgage payments. A third of bank mortgages in the country are insured by the Canada Mortgage and Housing Corp. When we look at the numbers more closely, the signs are encouraging. Although the accumulated debt of Canadians at the end of 2021 was over $2.6 trillion, not all of it is impacted by rising rates.

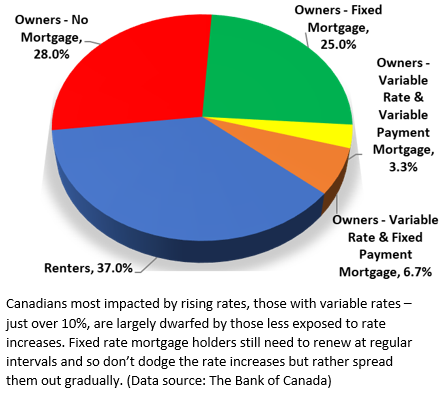

Homeowners who opted for variable rates are clearly feeling the brunt of the increases and fortunately variable rate mortgages make up only 10% of the Canadian housing market. Fixed rate mortgage payers will also feel the effects of rising rates but at a much more gradual pace. Of course, this only applies to homeowners who do not own their homes outright. Data shows that nearly 63% of households in Canada are homeowners and nearly half of them do not have a mortgage on their homes. This means that just 16% of Canadian homeowners will face the impacts of higher rates on their mortgages and home equity lines of credits.

Canadians’ high ownership share and strong reputation in paying off their mortgage make a borrower driven recession less likely and the data shows this. Less than 0.2% of mortgages in Canada were in arrears last year. Mortgage arrears are the missed or late payments on a mortgage loan. More encouraging, a third of bank mortgages (which is 90% of all mortgages) are insured by the Canada Mortgage and Housing Corporation. With insurance backed by the Canadian Government, it is clear why mortgage lending is so attractive.

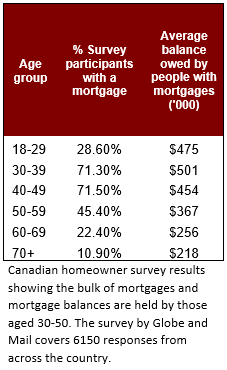

The national average resale house price in December was $626,318. The data table shows that Canadians with the most mortgage debt are younger on average and also in the earliest stages of their careers. That is to say that they are the youngest of the ownership cohort and thus have the greater earning potential. However, they are likely to be the most at risk of higher future mortgage interest payments since their level of capital held in their homes is much smaller than older Canadians.

Despite rising borrowing costs and decades high inflation Canadians are better placed for rate hikes now than in previous cycles. From a macro perspective, households' fundamentals are generally stronger than seen at the beginning of previous rate hiking cycles and the structure of household debt will shield many borrowers from the full impact of higher rates in the coming year. Additionally, the still booming labour market will help support those most at risk and pent-up demand will contribute to higher than normal spending on services in the coming year. While house prices may decline as a result of rising interest rates, a housing crash or property driven recession is unlikely.

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4