Knowledge Centre

Before the First Cut

October 2023

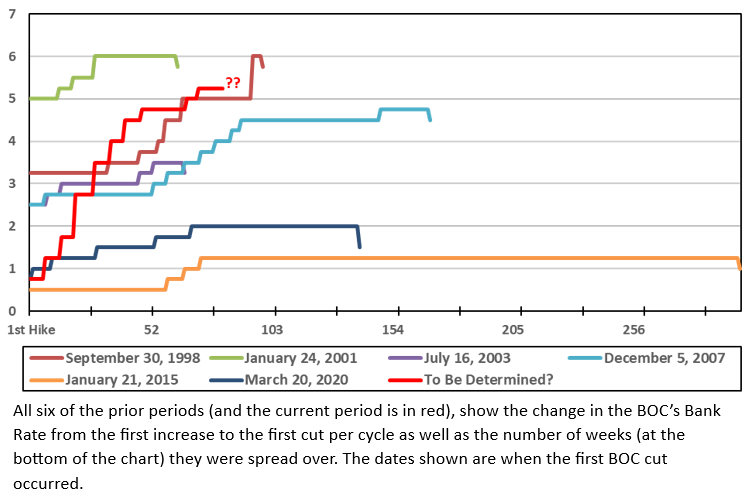

The end of the Bank of Canada’s (BOC) rate hiking cycle has historically been a good time to own Canadian stocks but an uncertain economic outlook and stretched valuations could dampen upside this time. After raising borrowing costs by 4.75% from March 2022 to July 2023, the BOC is widely expected to keep rates unchanged at 5.25% going forward. Interestingly, over the past 27 years the Bank Rate peaked out at 6.0% twice during two separate periods but nothing as dramatic as the current rate hiking cycle. Still, many investors believe policymakers are unlikely to raise rates any further thus bringing an end to the BOC’s most aggressive monetary policy tightening cycle in decades.

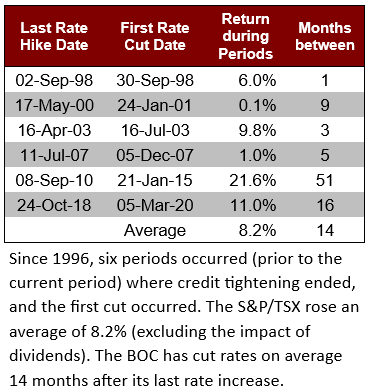

Since February 1996 the Bank Rate has been set by the Bank of Canada at the top of its operating band for the overnight rate. This provides a clearer indicator of monetary policy intentions. In December 2000, the BOC began setting the level of the Bank Rate and with it the target for the overnight rate (which is generally 0.25% below the Bank Rate) on eight fixed dates per year. The Bank of Canada’s reason for moving to this new guided future monetary policy approach is to increase faith in the markets because it is unexpected rate movements that: add uncertainty for financial markets; can increase inflation; and reduce trust of market participants in the policies of monetary authorities and so are counterproductive for the economy. The data to the left is from this period and the six rate hiking cycles that occurred in this time span were used to generate the accompanying information.

The market will probably cheer a bit if it is indeed the end of the rate hike cycle as stocks would be poised for gains. After the BOC’s prior six periods of credit tightening ended the S&P/TSX Composite Index rose an average of 8.2% (excluding the impact of dividends) from the time of the final rate hike to the first cut in the following cycle (see table to the left for the complete dataset).

Investors are very eager to see the BOC shut down its aggressive rate hiking cycle that has battered markets and tested investor morale. Although a pause in interest rate hikes appears likely, cuts may be farther off than some believe. The BOC will likely not slash rates too soon, at least if the economy stays hot and inflation remains sticky. Even if the BOC were to bring rates down soon an immediate bull run is not guaranteed. History shows that stocks tend to perform tepidly following a pivot to rate cuts compared to a pause.

The BOC has cut rates on average 14 months after its last rate increase with the S&P/TSX Composite Index gaining an average of 3.4% in the six months following the cut. Interestingly, prior to 2010 the BOC has held the peak rate typically for only several months. However, over the past 13 years rates have been held at peak levels for years (in the case of September 2010 to January 2015 for more that four years). BOC’s rate cutting cycles are generally mixed for stocks. Falling cycles are often immediately mildly bearish. It is only after more cuts that the S&P/TSX Composite Index starts to rise meaningfully again.

Though most investors believe a recession is unlikely in 2023, a slowdown next year remains a possibility for some market participants. Whether the recent rate rise by the Bank of Canada caps off the most aggressive tightening cycle in four decades is still being debated. This suggests caution around thinking there is a consistent pattern to apply for investment decision making. The problem is that there is no typical pattern when it comes to gauge when the Bank of Canada will begin easing monetary policy.

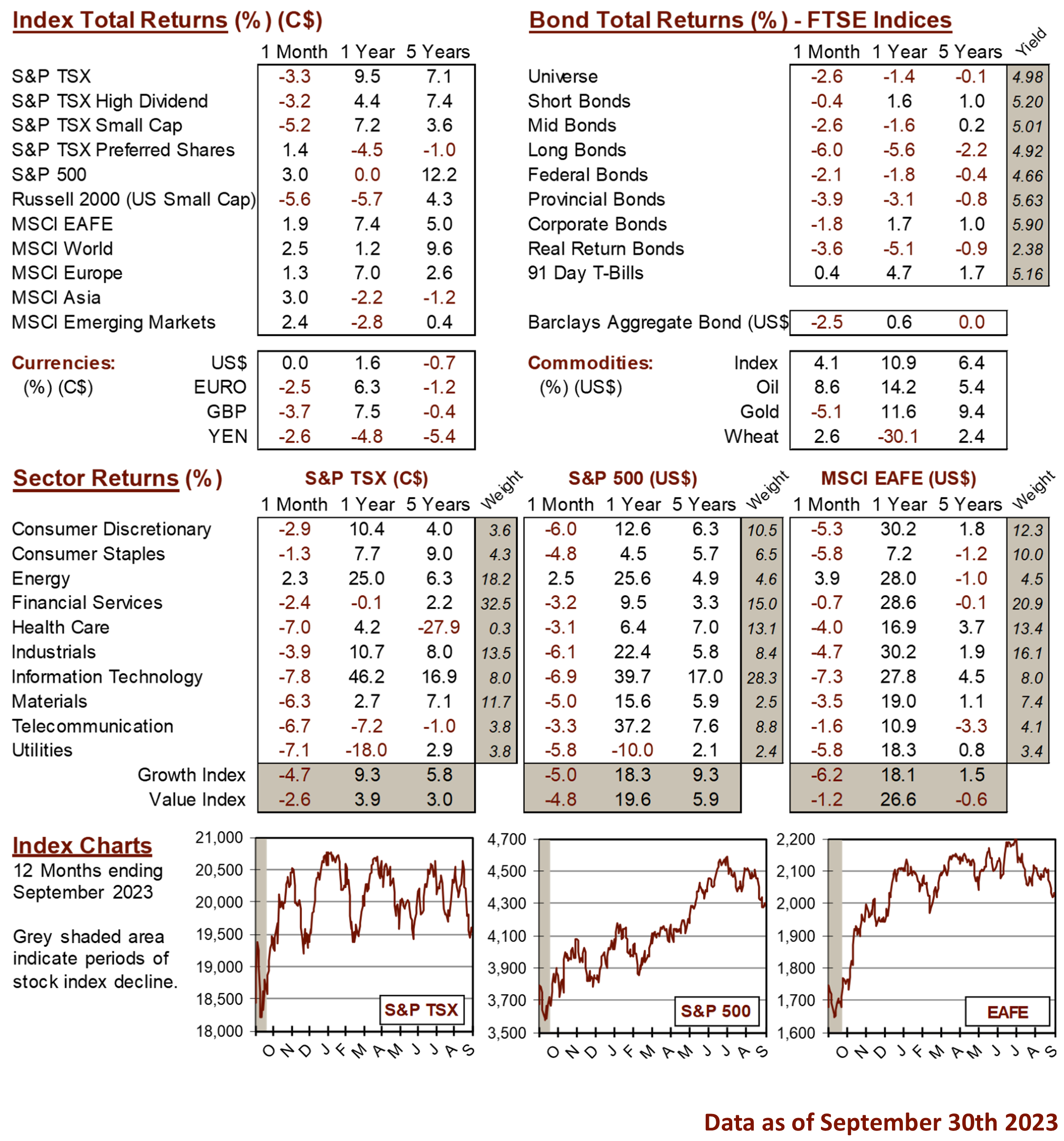

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4