Knowledge Centre

Bond Spread vs Exchange Rate

February 2025

The Canadian dollar (CAD) finished 2024 at $1.45 Canadian dollars (CAD) for one U.S. dollar (USD), the weakest it has been since February 2002 when it was $1.60. While there are numerous risks ahead in 2025, with the threat of a smothering tariff on Canadian goods and services being most immediate, we are likely not seeing the beginning of the end for Canada’s economy but the beginning of a crushing devaluation of the Canadian dollar in 2025.

Currently the spread between Canada 5 year bonds and U.S. 5 year bonds is 1.59%; the most in over four decades. Eventually this spread will revert back to more normal levels when yields begin to fall for U.S. Treasuries. The current spread is not justified over the long term given economic and inflation outlooks for the two countries and their relative creditworthiness. To a certain degree the yield difference is being manipulated with the intention of devaluing the Canadian dollar as a means of minimizing the impact of tariffs and enhancing Canadian exporters’ ability to keep their costs low relative to U.S. manufacturers.

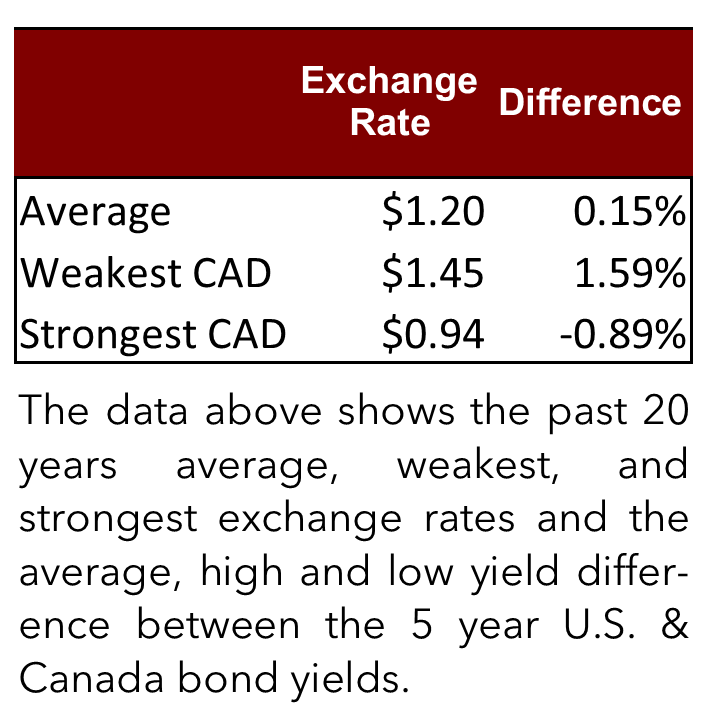

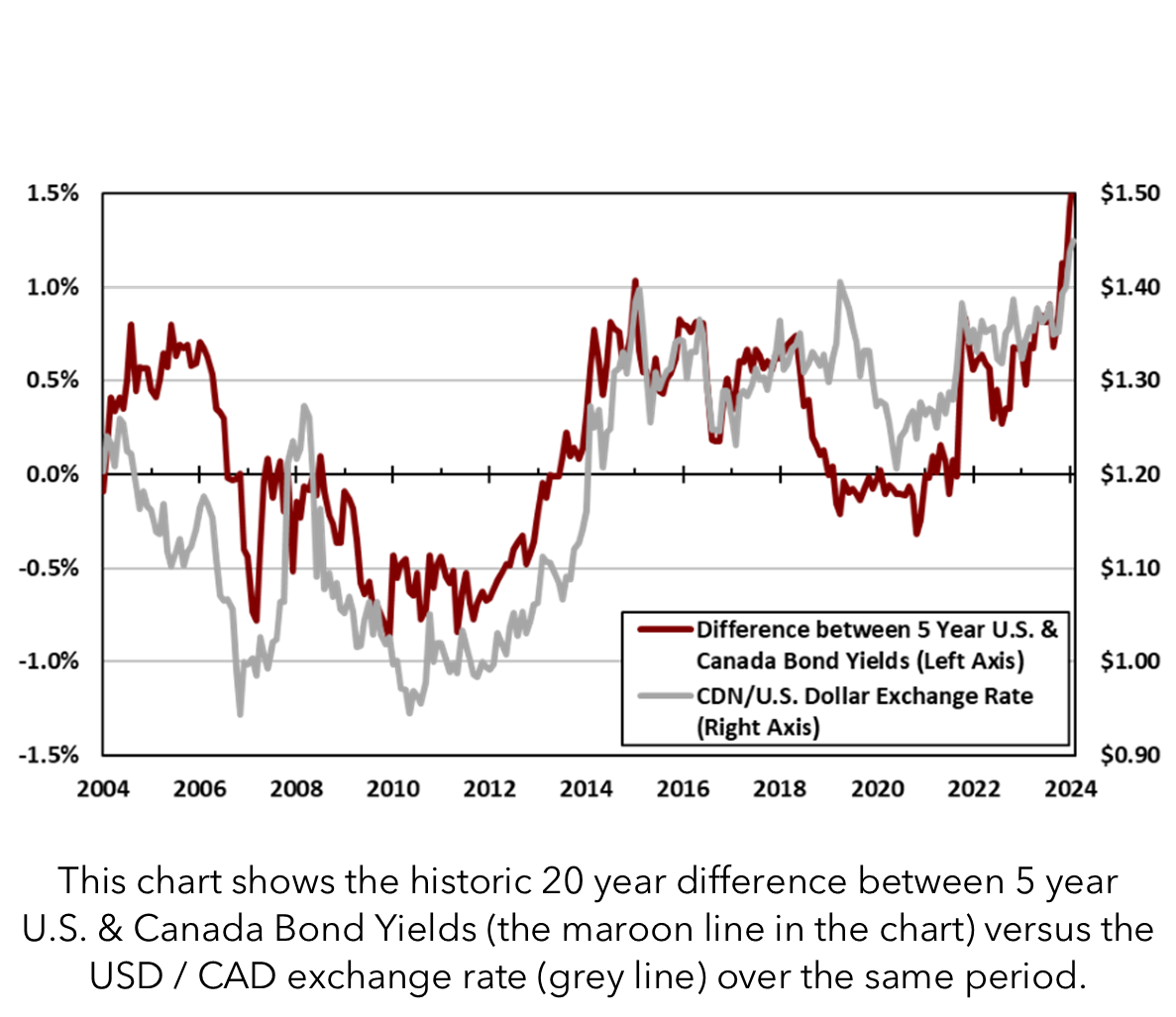

The chart and data to the left both show the Canadian dollar is currently the weakest it’s been in 20 years, compared to the average exchange rate of $1.20. The difference between 5 year U.S. and 5 year Canada bond yields (the maroon line in the chart) closely mirrors the USD / CAD exchange rate over this period. In fact they have a very high correlation of movement at 0.75. So, in essence where one goes the other will follow.

The Canadian dollar will eventually rally normalizing the relative value of the two bonds and how the exchange rate traditionally moves when yield spreads change. Of course, it is difficult to be optimistic about the Canadian dollar right now. Spreads between corporate and government bonds narrowed during 2024 which tells us that the bond market is almost completely discounting the possibility of a recession which would hurt the corporate bond sector.

The strength of the U.S. dollar may reverse if President Trump tries to put pressure on the Federal Reserve to lower interest rates as he did during his first term. At the same time, new economic policies will likely have varying effects: a trade war could lower economic growth especially if the incoming administration is underestimating the negative effects that tariffs would have on the U.S. economy; tax cuts may be stimulative, big cuts in government spending are likely to slow the economy in the short term but could eventually deliver longer term benefits.

For now, we endure lower U.S. bond yields and a high U.S. dollar with the expectation that a stronger Canadian dollar is quite a ways down the road. The Canadian dollar could remain historically weak for several quarters reflecting lower potential growth in Canada and an output gap that’s likely to narrow only gradually. However, the loonie should be ripe for a rebound toward the end of 2025.

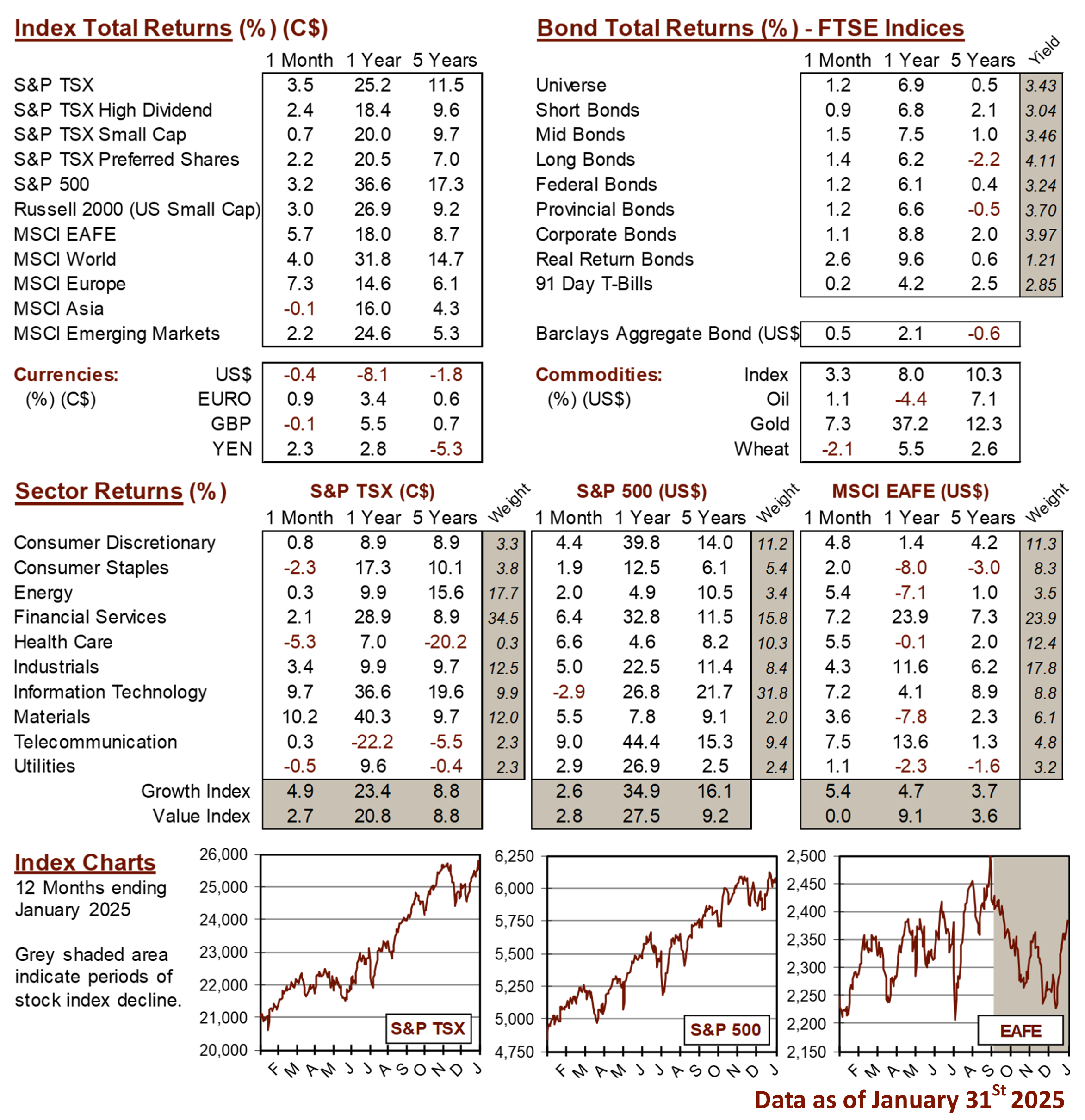

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4