Knowledge Centre

Canadian Equity Turbulence

March 2025

So far this year the S&P / TSX Composite Equity Index is up 3.1% but what does the future hold? Currently the biggest risk is centered around the new U.S. administration polices and specifically the potential impact from Canada being hit with new tariffs. There is no doubt that the U.S. imposed tariffs and the inevitable Canadian retaliation will hurt the economy. The markets have remained mostly immune to the headlines so far but patience and tolerance is being tested. The current sabre rattling is very questionable given that the U.S. runs an almost US$40 billion trade deficit with Canada. When taken as a share of total two way trade the deficit looks miniscule. However, as the U.S. is Canada’s largest trading partner (accounting for 75% of our exports, 25% of our GDP and approximately 2.4 million jobs) the pain could be very real.

The latest tariff announcement is for 25% on all imports from Canada. If this is implemented the pain would be felt in both Canada and the U.S. with the most heavily impacted sectors being energy, autos, mining, pharmaceuticals, chemical and forestry products. If no exemptions are granted this policy could push Canada’s economy into recession with an estimated 2.6% decline in 2025. However, it would also represent a significant disruption to the U.S. economy, which could fall 1.6%.

As most investors know the economy is not the stock market. The two are not always related even though historically a recession often follows a market correction not the other way around. Canada has had five recessions of six months or more since 1970: January 1980 to June 1980 (6 months); June 1981 to October 1982 (17 months); March 1990 to April 1992 (13 months); October 2008 to May 2009 (8 months); and March 2020 to August 2020 (6 months).

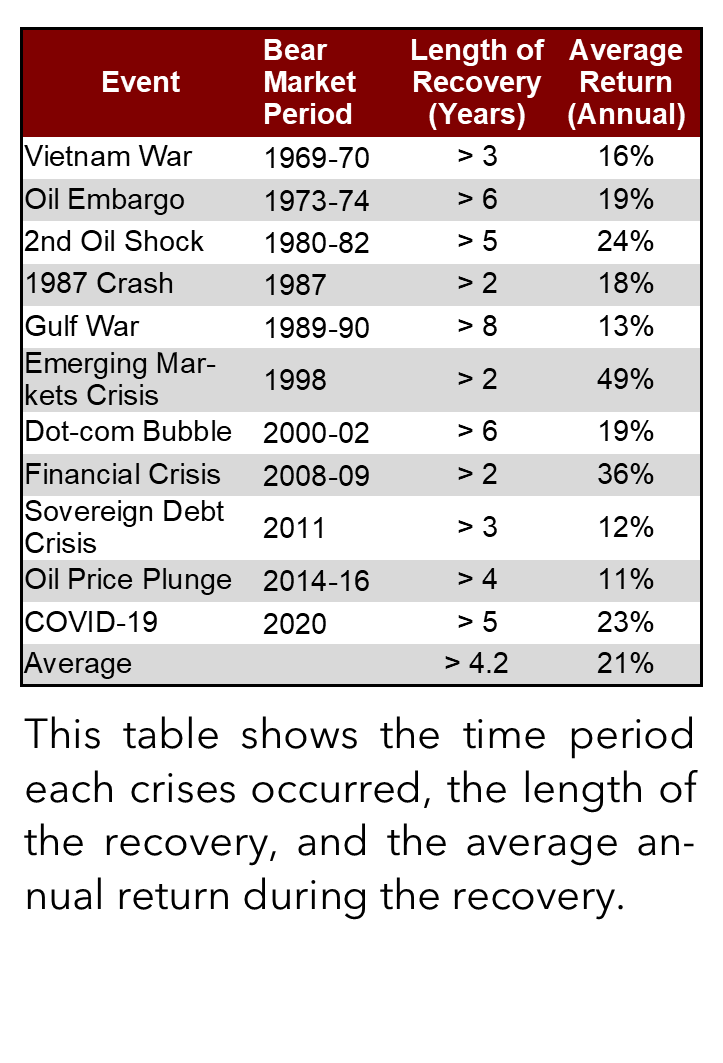

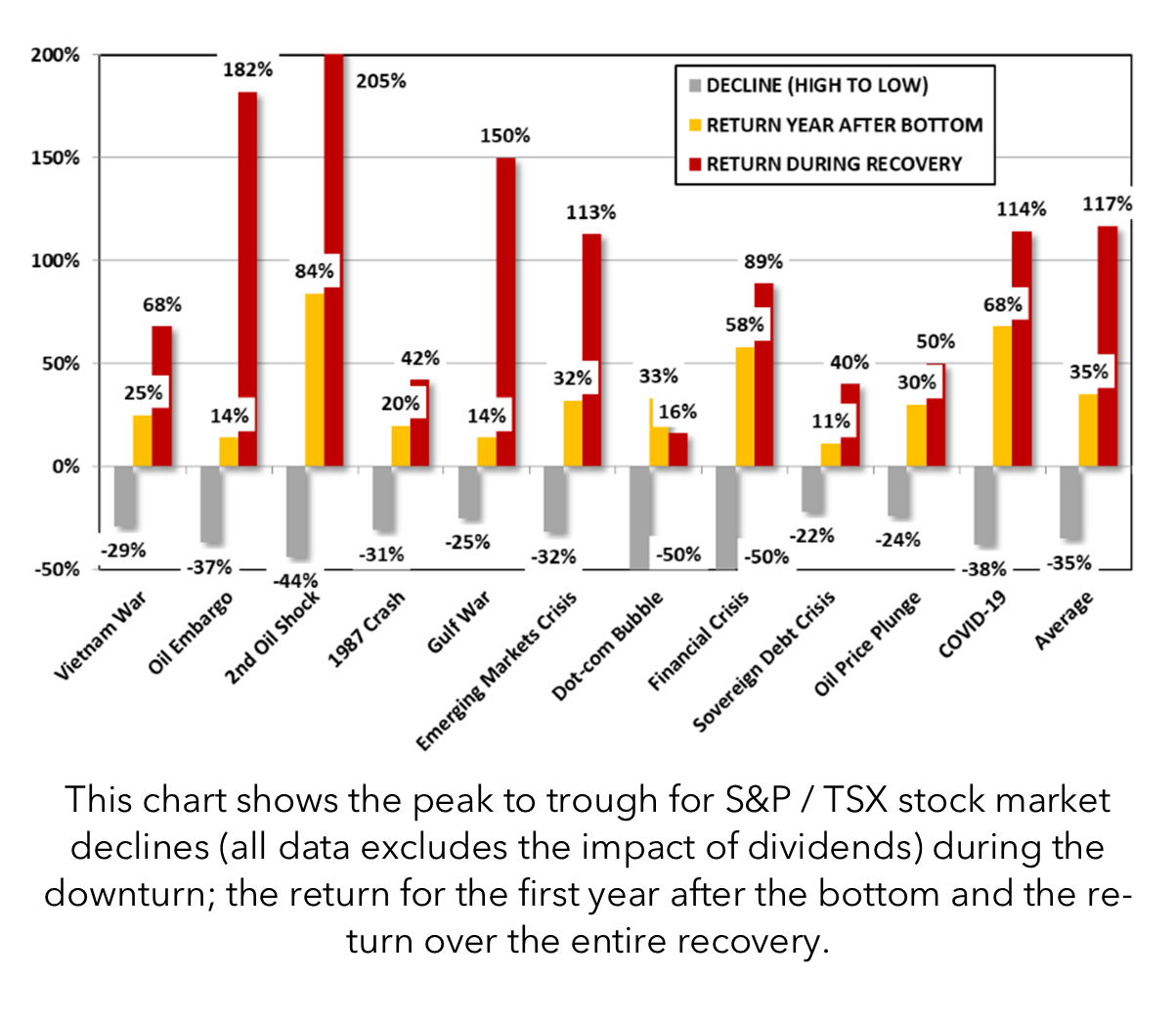

Examining previous bear markets with 20% declines or more and reviewing the subsequent recoveries can help investors avoid costly mistakes. The accompanying chart and table show the 11 significant Canadian stock market declines since 1970. The chart shows the peak to trough for S&P / TSX stock market declines (all data excludes the impact of dividends) during the downturn; the return for the first year after the bottom and the return over the entire recovery. During these crises, Canadian stocks declined by an average of 35%, then almost fully recovered the entire decline over the following year, and more than doubled in the subsequent recovery. The table shows the time period each crises occurred, the length of the recovery, and the average annual return during the recovery.

Even more insightful is what happens if the correction is not as severe, and the stock market only declines only 10%. This might be more realistic since financial, telecom, real estate, energy, and materials stocks account for roughly two-thirds of the S&P / TSX and are expected to escape the direct impact of tariffs or benefit from carve-outs. Over the same time period since 1970 there have been 16 market downturns of 10% or more with an average decline of 14.9%. Remarkably it only took 18 weeks to recoup all the losses after these selloffs.

The threat of U.S. tariffs is Canada’s most urgent economic challenge and with good reason. Whether or not Canada is on the verge of a recession, the key for investors is to not panic. The biggest stock market drops tend to come from a macro event or global exogenous shock. A stock market crisis can be a stressful event. However, if the past is any indication, investors who keep calm and ride out the downturn instead of panicking and selling at what would be the worst time tend to be rewarded during the subsequent upturns.

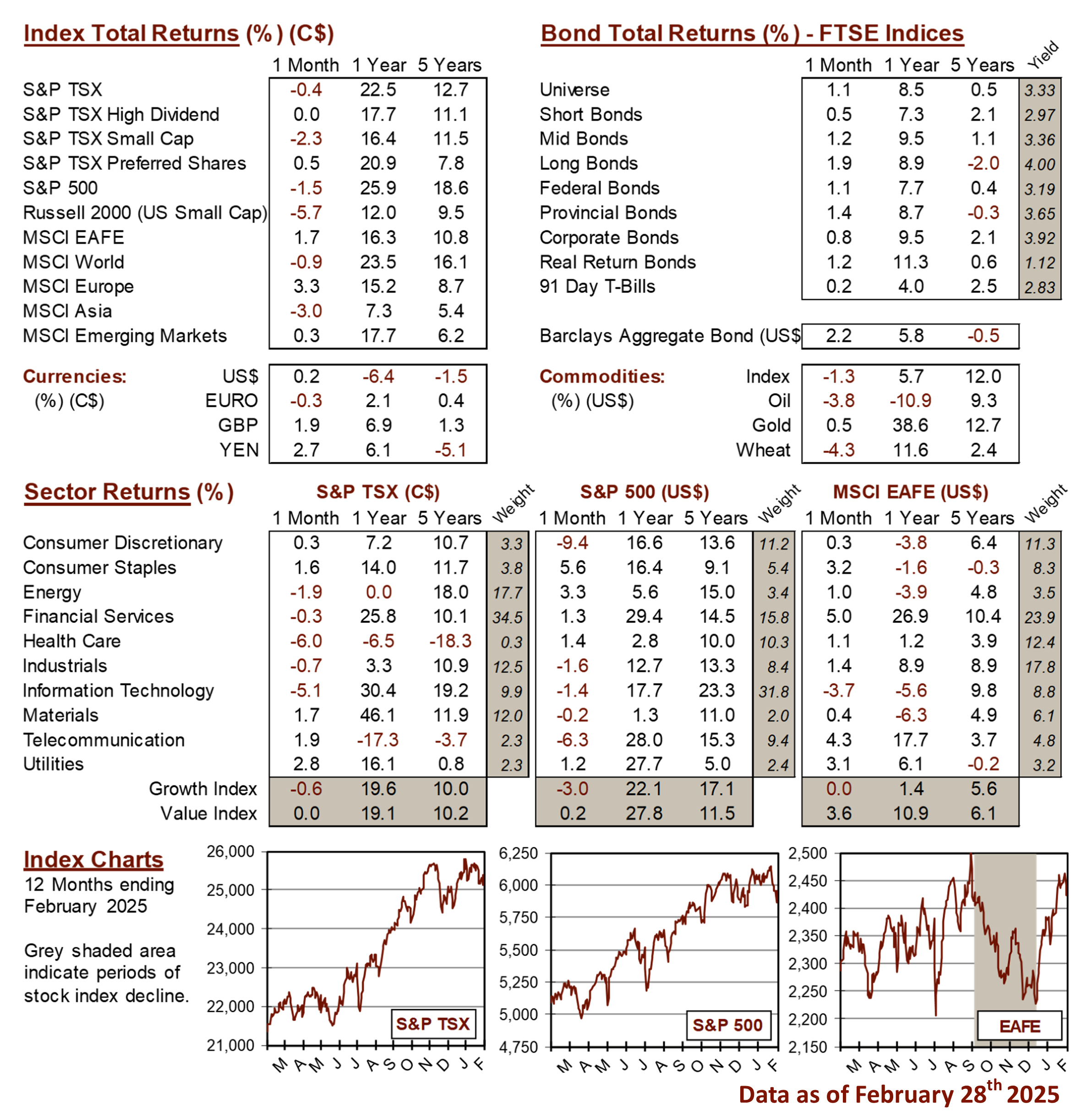

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4