Knowledge Centre

Balanced Portfolios Still Work

December 2021

When investing in capital markets, investors have a wide array of choices. The primary task facing investors is choosing between bonds, stocks, or a mix of both. The current investment climate is a unique one filled with a sentiment of euphoria from seemingly new highs reached every month coupled with market anxiety swirling around covid variants and geopolitics.

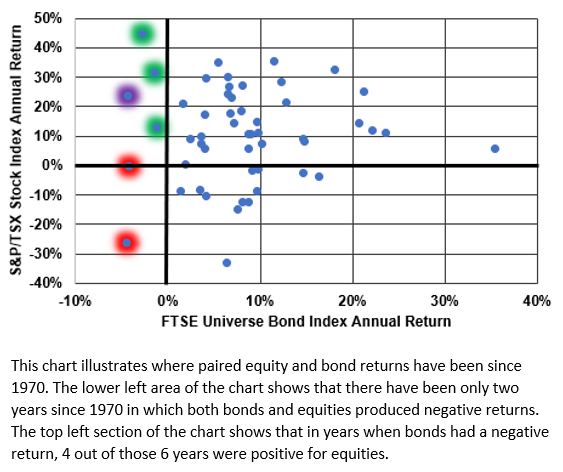

As indicated by the purple data point in the chart to the right, 2021 has been a rare year as bonds experienced negative returns while equities have picked up the slack returning over 21% YTD. This is modern portfolio theory at work. As bond performance was negative over the year, equities were more than able to compensate for lost returns. There have been only two instances over the past 52 years in which bonds generated negative returns and equities were not able to compensate (1974 and 1994).

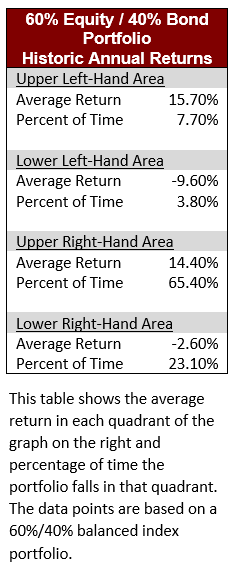

Looking at the base cases of 100% bonds vs 100% equities, the S&P/TSX has outperformed the FTSE Universe nearly 60% of the time over the past 52 years. Equities have been much more volatile during this period with twice the volatility of bonds, making bond returns more predictable. An investor willing to ride the turbulence of pure equity exposure undoubtedly would reap great rewards over the past 52 years (45% in 1979, 33% in 1993, 35% in 2009) but would have also faced years of huge losses along the way (-33% in 2008, -26% in 1974). On the flip side an investor of only bonds would rarely experience a negative return year; the FTSE has only had six years of negative calendar year returns since 1970. Given the historically low risk, low return profile of bonds and higher risk, higher return of equities; and given that it is not an either/or choice, investors can combine the two to lower their portfolio’s overall risk profile. A balanced mix of equities and fixed income can protect investors from inevitable down periods for markets which tend to hurt equities much more than bonds and periods of increased inflation which erode the capital distributions of bonds while often boosting equity prices.

Given the profile of stocks and bonds, it is vital to weigh the risk/reward balance accurately. Investors want their portfolios to generate the maximum return for a given level of risk. As bonds have a negative correlation to equities, we can reduce our level of risk without negatively impacting total returns.

While history does not always repeat itself and past returns are not necessarily indicative of future returns, unfortunate global and market events are bound to happen, and the prudent investor would be wise to be in a balanced, well protected portfolio.

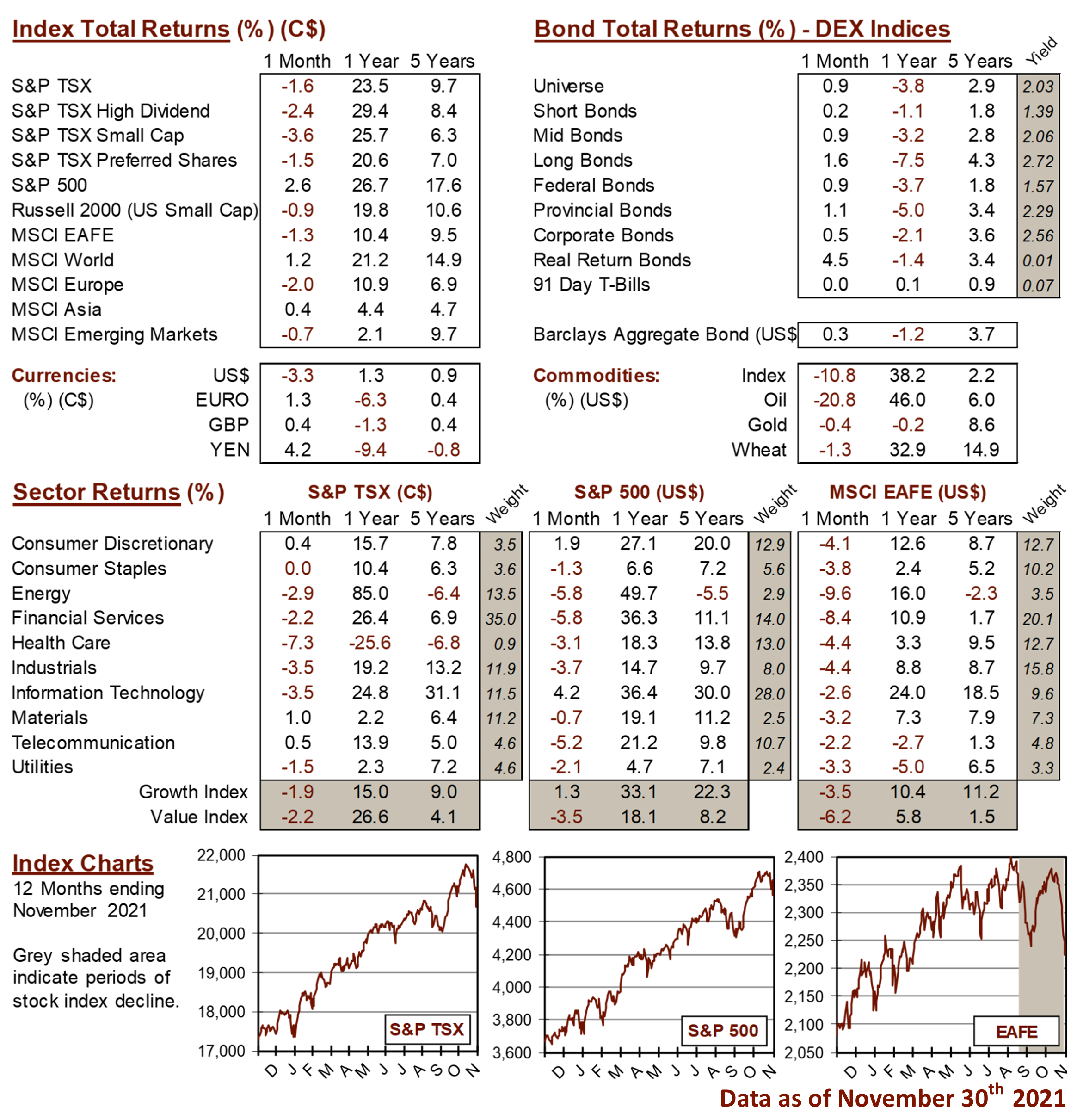

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4