Knowledge Centre

Bouncing Back

April 2025

Whenever stock markets go into the doldrums, whether it is due to a decline in business prospects, economic shocks, simply a shift in the business cycle or ridiculous trade wars, many long-term investors will reflect on the prospects for staying invested and may even consider adding new money to what until recently had been deemed securities with poor prospects. It can be very profitable to venture back into the market at the appropriate moment. Of course, timing is the difficult part to judge.

There is no definitive way to determine how far stocks will fall or how long it will take for them to reach the bottom. It’s no surprise that tariffs are on the minds of investors as that is the key question they face. The current fear is that economic growth may slow or stall, and this has even the bulls wondering if stocks could drop. So far this year the Canadian stock market has held its ground despite shocking developments and potential impending doom. However, this does not preclude that a decline in Canadian stocks will occur. it just means, as history suggests, investors are generally rewarded for having the courage to remain invested or being astute enough to buy on dips.

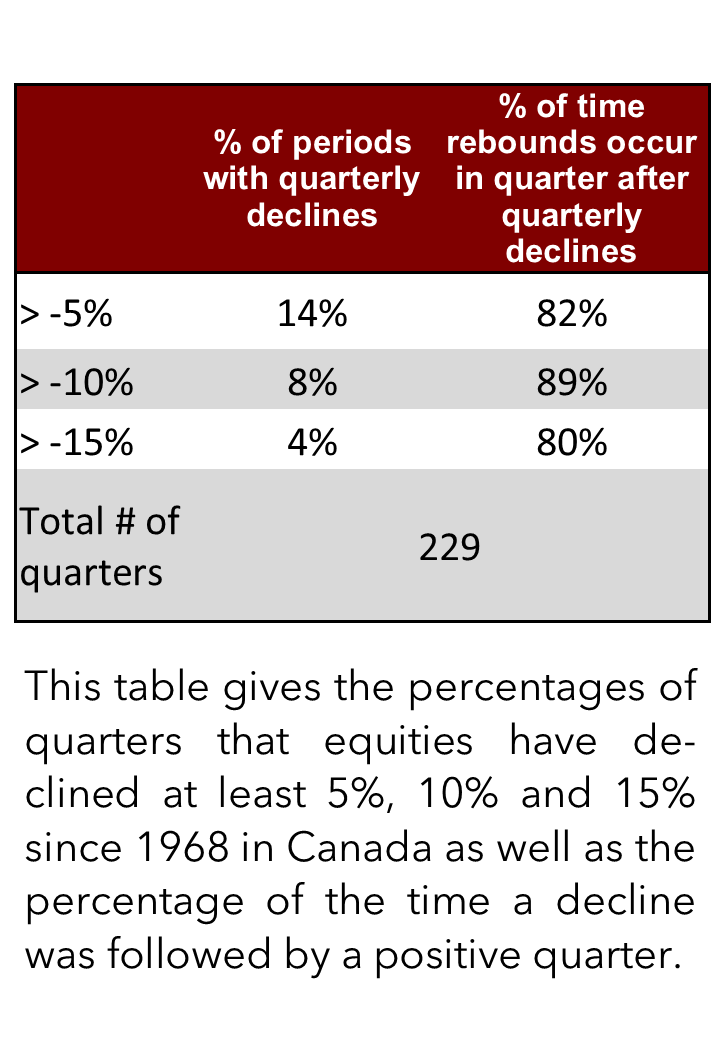

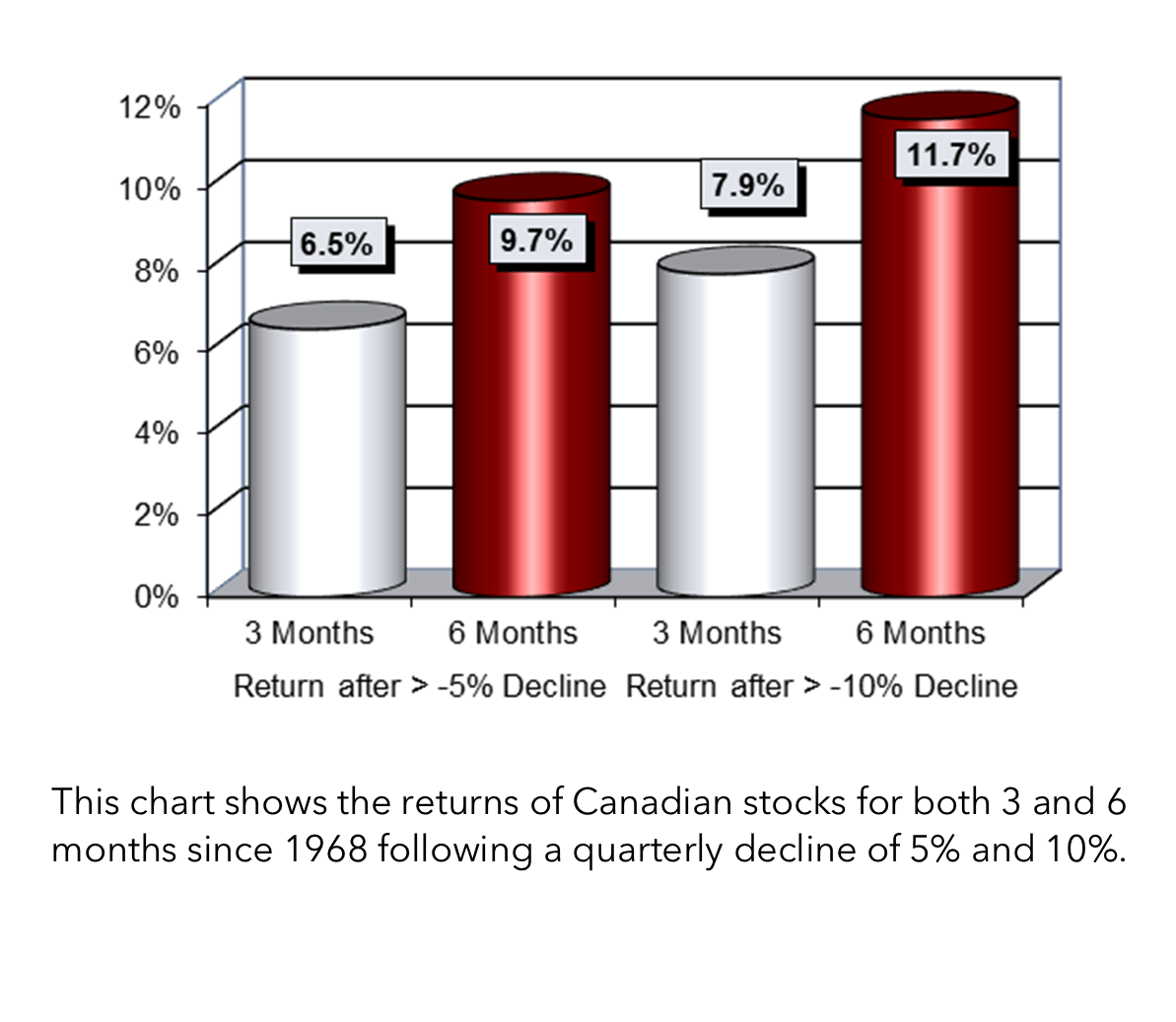

Looking for positive trends after a sell-off is a difficult job but once signs emerge that markets have priced in most of the bad news then investors have to ask when stocks will begin to rise. Time and time again the pattern is repeated. Investors get carried away selling but then reflect as values increase and they start buying again. According to an analysis of Canadian stock prices going back to 1968, stocks tended to climb in quarters following big declines. Quite simply the stock market is like a rubber band where if you stretch it too far it will bounce back.

Since 1968 stocks have fallen 10% or more in 17 out of 229 quarters. The next quarter following the 10% drop saw stocks rise on 19 occasions or 89% of the time. As the chart to the right shows, not only are the quarterly returns after a decline usually quite strong, but the trend also tends to continue for at least six months into the future. Even after stock market declines of only 5% per quarter the frequency of snapping back is still greater than 82% although the degree of recovery is not quite as great. This same pattern of “the harder you fall, the higher you bounce” has occurred in the U.S. since the 1920s. In fact, for those quarters when stocks rose after falling 15% or more, the rebound averaged an astonishing 80%.

The big question is when the stock markets do decline (as they absolutely will) does this pattern continue? Stock markets tend to look six months or more in the future. Some of the biggest gains have come before economic recoveries when unemployment is still high and growth is low. Investors should be prepared for upside surprises to come slowly, since the prevailing market psychology of "business is bad" will tend to linger for a while. Stocks will still go through hard times but these downturns can create exceptional investment opportunities for those who can balance the patience and assertiveness required.

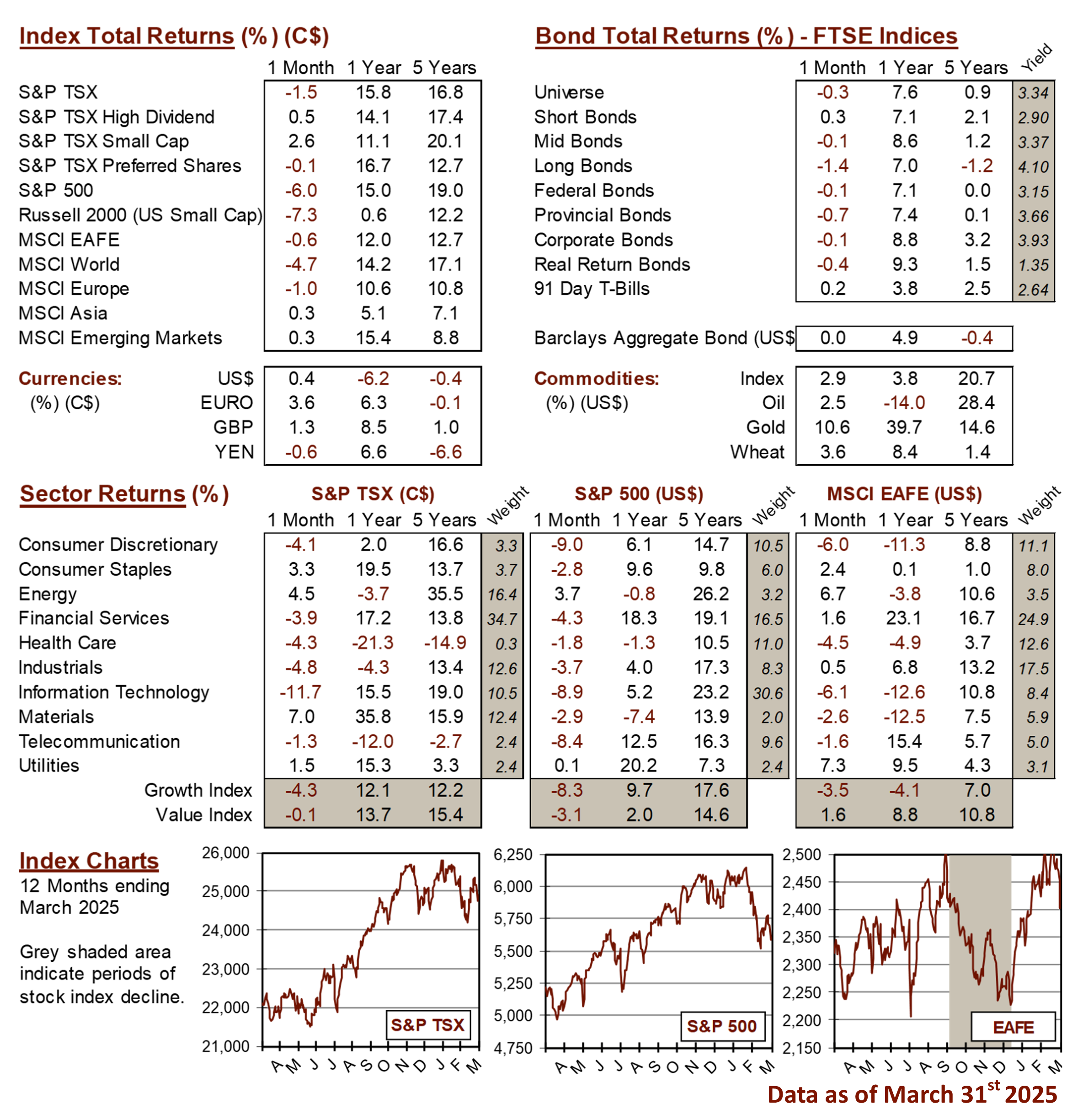

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4