Knowledge Centre

Canadian Equity Loyalty Lags

January 2025

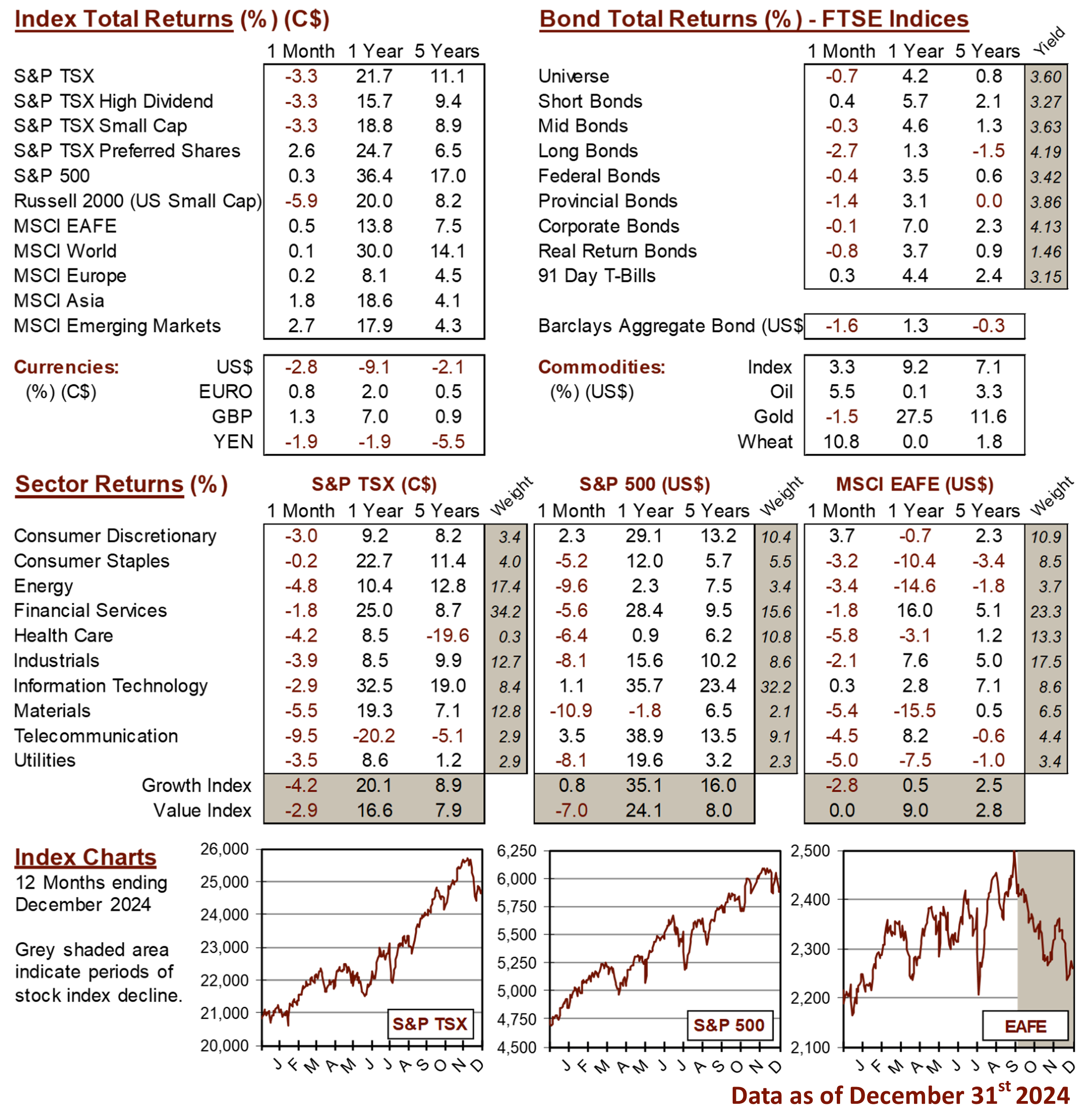

The past couple of years have been a very good time to be a Canadian equity investor. Canada has enjoyed back to back banner years with the S&P/TSX Composite returning 11.8% in 2023 and 21.7% in 2024, outperforming most international markets. Despite good recent performance, Canada has dramatically underperformed the U.S. stock market over the last decade. During the 1980s and 1990s, Canadian stocks were lagging the rest of the world and yet Canadian investors retained a high domestic equity exposure. Canadians are overweight domestic stocks, either due to loyalty or simply a fear of venturing outside our comfort zone.

A home bias can be observed in every country, but it is potentially a bigger problem in relatively small markets like Canada. The average U.S. investor holds 70% of their equities in American stocks but the U.S. makes up close to 73.9% of global equity market capitalization (as of November 2024 - the highest level on record). Canada is not only tiny (3.1% of global market capitalization), but also highly concentrated with more than 61.4% of our stocks in the financial, energy and material sectors and 36.5% in the ten largest companies. There are legitimate reasons for concentrating investments in your home country but the real reason for Canadian home bias is mostly behavioral.

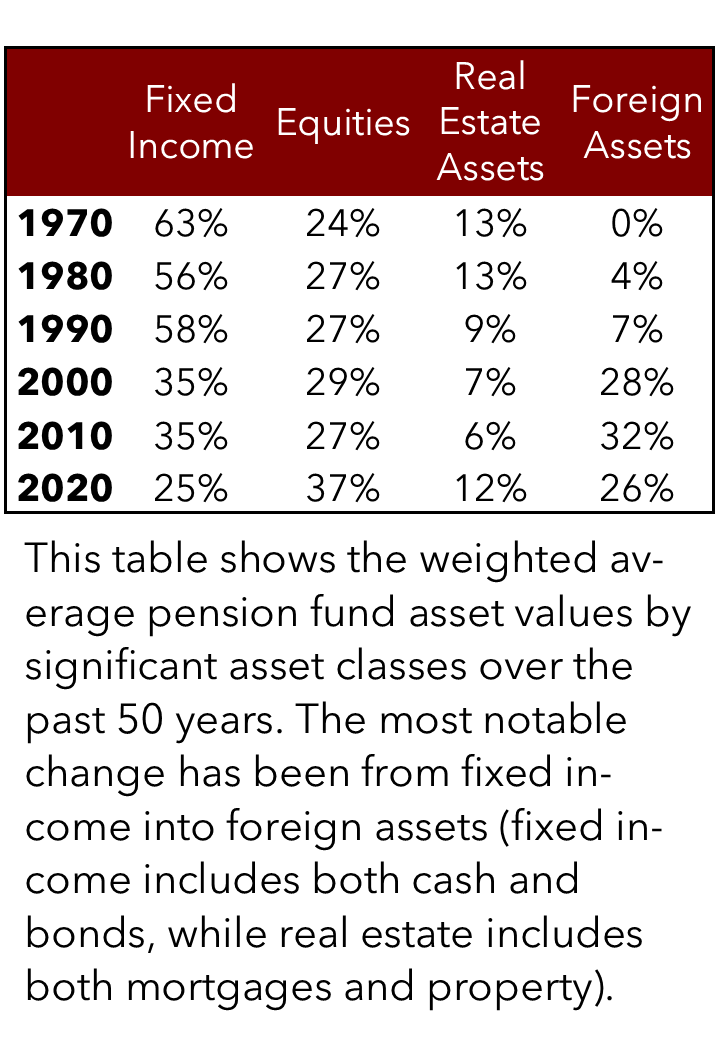

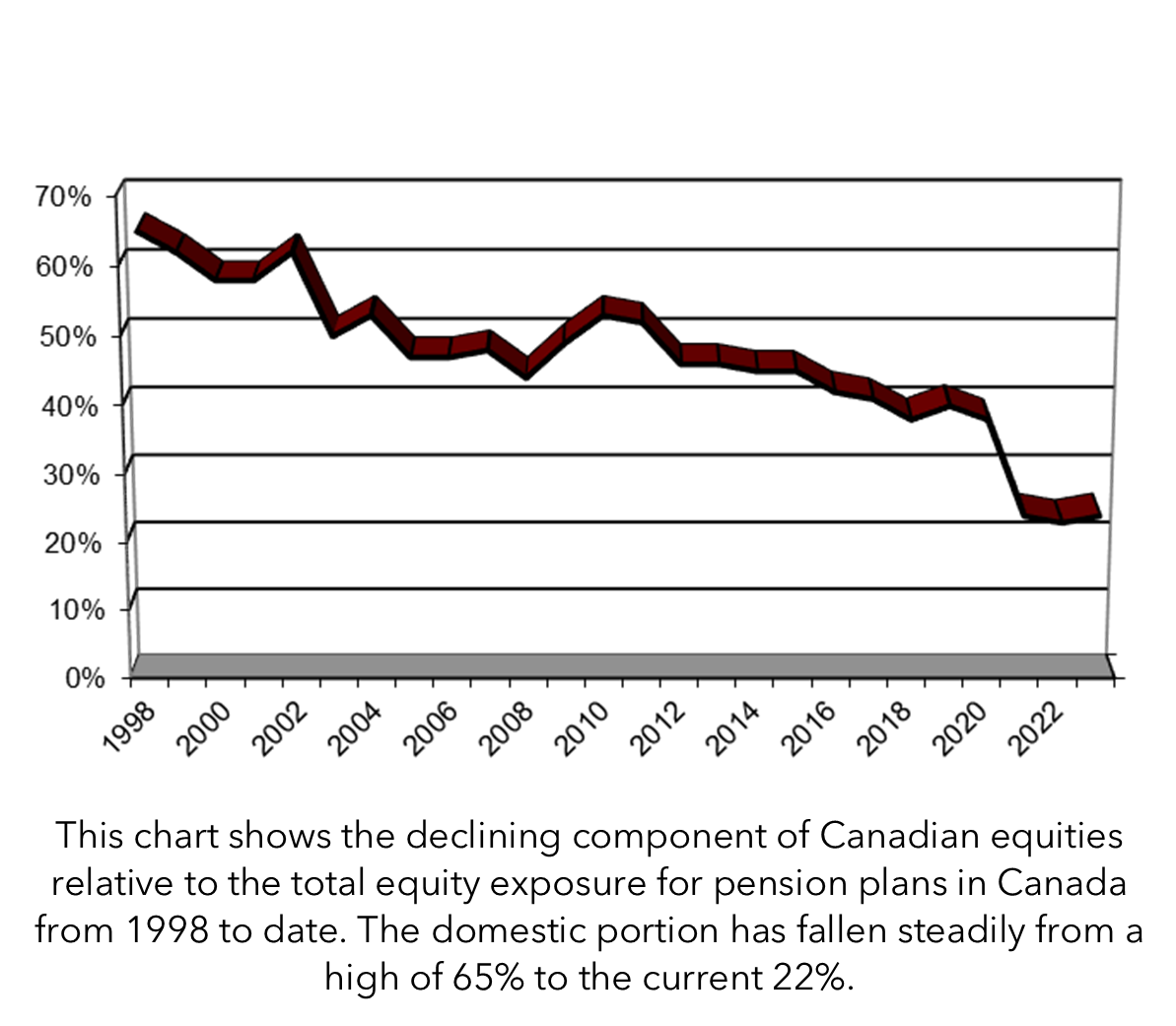

All investors face the key challenge of deciding how much to allocate amongst the various asset classes. International diversification can benefit investors by improving potential returns while reducing volatility, so it is critical to assess the advantages of staying close to home or seeking the risk reduction benefits of a global portfolio. Since 1998, as this chart shows, pension plans (with assets in 2023 of $2.2 trillion) in Canada have steadily reduced their domestic equity weighting from a high of 65% to the current 22%. Similarly, the data in the table to the left shows a very similar pattern of assets migrating to international securities. Plausible explanations for this trend include increased globalization, free trade growth, the proliferation of the internet, the rise of emerging markets, and increased mutual fund investment.

As major global economies become steadily more intertwined the increase in international equity exposure for Canadians has continually crept higher. The evidence confirms that there are both higher returns and lower risk available through increased international diversification. Yet despite significant gains to be made from international diversification, many individual investors continue to stick to domestic equities.

Of course, there are a number of legitimate arguments for retaining a high exposure to Canadian securities. It is true that Canadian retirement expenses will be paid in Canadian dollars and costs are generally lower when you buy Canadian investments as there are no currency conversion costs. Furthermore, there is a meaningful dividend tax advantage for owning domestic securities and Canadian investors have more information about domestic companies; but these reasons do not make international investing a bad thing. Since most Canadians have careers, pensions and real estate holdings denominated in Canadian dollars they are already concentrated in Canada by default. For Canadian investors seeking equity exposure, international diversification can provide good risk and return trade offs, complementing the strong Canadian market.

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4