Knowledge Centre

DAYTIME IS FOR LOSERS

June 2019

A widespread misconception is that the stock markets are only open in the daytime. This is wrong considering that stock markets continue to work during the night. In fact, it appears that the daytime market is not where the best results are obtained. Overnight is when the real money is earned; not by trading during the day, but by resting peacefully at night.

Quite simply the price returns from the 4 p.m. market close to its opening at 9:30 a.m. the following day is when investors make their money. Conversely, during the hours that the market is open is when investors actually see negative returns on average. This is because stock prices at the market open tend to gap higher, over and above the previous day’s closing price. So, for investors the buy and hold approach, while ignoring the impulse to frequently trade, is the winning strategy.

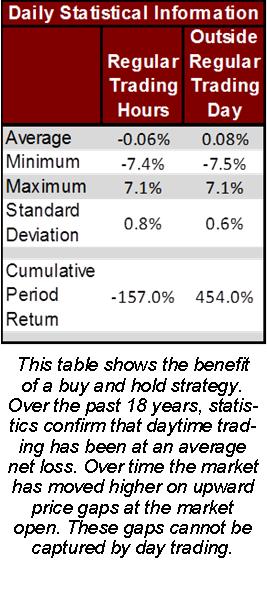

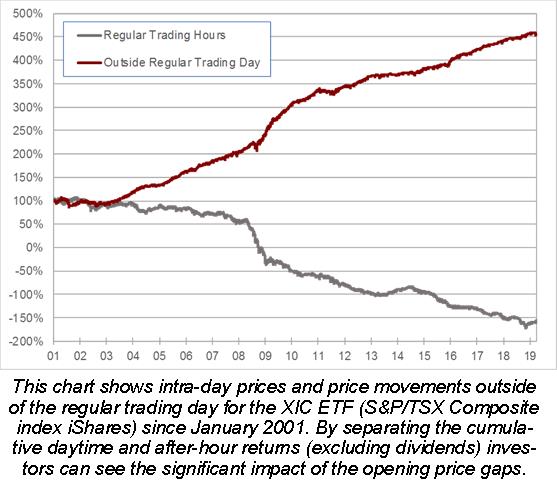

The chart below and the data to the left show the price movements for the iShares S&P/TSX Composite index ETF (ticker symbol XIC), both intra-day and outside of the regular trading day, since January 2001. This ETF mirrors the Standard & Poor’s / TSX index, which often serves as a proxy for the entire Canadian stock market. The information shows the cumulative impact of separating the daytime from the after-hour returns excluding the impact of dividends. Since 2001, all of the S&P/TSX’s gains have occurred outside regular trading hours between 4 p.m. and 9:30 a.m. In other words, for 18 years the daytime has been a net loss while the cumulative net after-hour gains were 454%. Case in point; if you were to buy the iShares S&P/TSX Composite index ETF at the first second of regular trading every morning at 9:30 a.m. and sell it at the 4 p.m. close, you would have been down -157%. Or as the data to the left shows, during every trading day on average for the past 18 years investors would have lost 0.06% versus the overnight gain of 0.08%.

As an example, this analysis shows that during the bear market year of 2008, the overall market, as represented by the iShares S&P/TSX Composite index ETF, declined -35.4% (excluding the impact of dividends). But most of the damage occurred during the day, with losses of -63.5%, compared with an actual gain of 26.9% overnight. Part of the reason for this gap in returns can be explained by the fact investors tend to panic at bad news. Panic seems to happen during the day, when skittish investors overreact.

Clearly buying and holding has been an extremely profitable strategy which coincides with most investors’ long term focus. As such, the very short term possibility of attempting to strategically time the market intraday is really just an illusion, likely compounded by more frequent daily trading. The evidence speaks for itself. The bottom line is that if you have more than a one day time horizon as your investment philosophy, forget about the news and the market ups and downs during the day. Slow and steady wins the race. Most investors tend to be better off if they just sit tight. Trading for a relatively minor blip in performance at the end of the day is not worth a hill of beans.

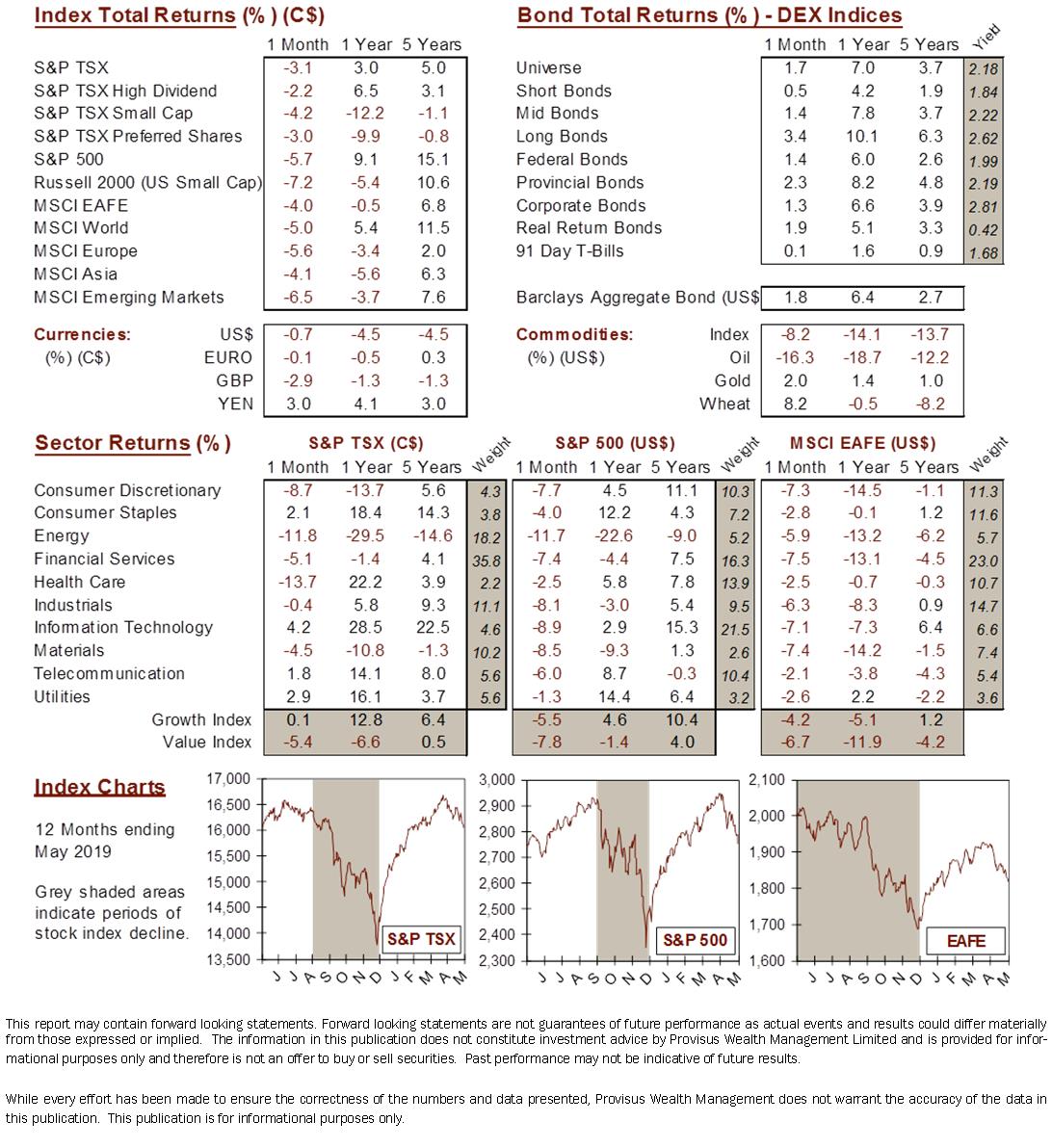

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4