Knowledge Centre

Diversifying with Dividends

June 2022

Needless to say, 2022 has not been as fruitful for investors as the previous 18 months that followed the outbreak of COVID-19. Extremely low interest rates, combined with stimulative fiscal and monetary policies resulted in an extremely rewarding period for equity investors, especially in higher risk, growth oriented investments. However, as history shows, a hot market cannot last forever and there will inevitably be periods of market declines, lackluster investor sentiment and lagging performance.

On a macro level there is a lot to unpack. Although job numbers are coming in strong, there have been massive delays in air and ocean freight due to labour shortages, lack of empty shipping containers, congested ports and lagging inventories. Just as COVID-19 shutdowns appeared to be a thing of the past, China introduced peak pandemic level restrictions again, resulting in severe port congestion in the region which had already exasperated the global supply chain slowdown. Another obstacle is Russia’s invasion of their neighbours in Ukraine which has resulted in strong sanctions. Russia sourced roughly 35% of Europe’s natural gas.

With inflation soaring and the economy running a little too hot, the Bank of Canada (BOC) was faced with the impossible task of soft landing the economy. It raised the key rate to 1.5% on June 1st with prior hikes occurring in March and April. It is poised to ramp up the rate hike cycle aggressively as further evidence of economic resilience emerges. The actions by the BOC should be good for the economy in the long term but places investors in a tricky position in the near term. This combination of rising yields to cool the economy coupled with increased inflation expectations has not only slowed growth-oriented equities but has also decreased the expected return of bonds. While bonds have long been a steady and reliable investment in which to park cash, this new inflationary/rising rate scenario has not been productive for the asset class.

This is where cash and high cash generating equities really earn their place in a portfolio. Cash is a particularly attractive holding in a rising rate environment. As the more interest rate sensitive stocks and bonds feel the effects of high inflation, dividend paying stock prices tend to reflect more near term benefits. Every quarter, large publicly traded companies pay a percentage of their net income back to investors in the form of dividends. Not every company pays dividends, but those who have a track record of consistent dividend payouts are typically large, stable companies which have stood the test of time, experiencing many market cycles.

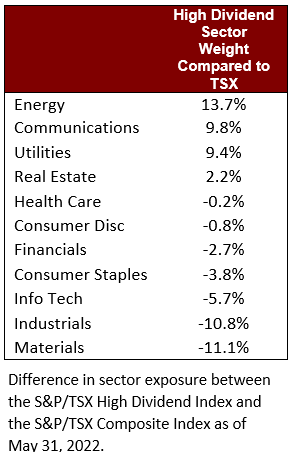

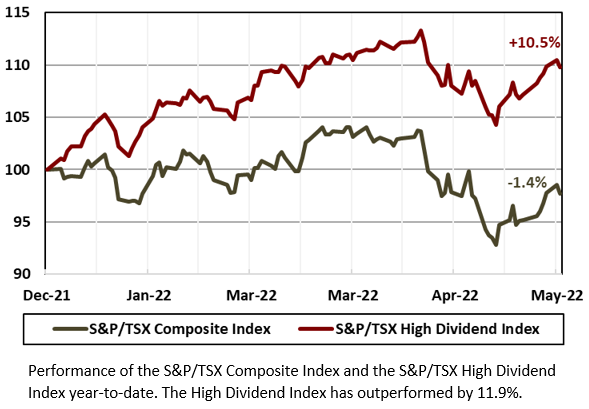

Dividend paying companies offer more than just yield. On a valuation basis, the S&P/TSX High Dividend Total Return Index offers a 5% discount relative to the S&P/TSX Capped Composite Index and year to date, has outperformed the S&P/TSX Index by nearly 11.9%. Over the past 10 years the S&P/TSX High Dividend Total Return Index has outperformed the broader index by a meager 0.2% (9.5% versus 9.3% per year). This is an important takeaway as history has shown that shifting assets into dividend paying companies is not a strategy that consistently yields superior outperformance. Like most things there is a time and a place for all philosophies because conditions can reverse themselves very quickly. Companies which pay dividends come from a wider range of industries offering a higher degree of diversification, which we know is the best way to reduce the overall risk of a portfolio. As the table shows, the High Dividend Index has a materially greater exposure to Energy, Communication Services and Utilities. These sectors can provide an attractive yield relative to the broader market. It also shows the relatively cheaper valuation, higher yield, and outperformance over the last decade.

Companies which are able to produce a steady, predictable flow of dividend income will reward their investors with a special dividend, evidence of a stronger competitive position to enhance a prudent investor’s portfolio returns. The High Yield Index is also more concentrated and has a smaller market cap index to the broader market. As of May 31, 2022, the S&P/TSX High Dividend Total Return Index offers a yield of 4.39% which is 55% higher than the S&P/TSX Composite Index yield of 2.84%. This extra, nearly 2% yield is an important return driver during a period of uncertainty and sideways, broad market performance.

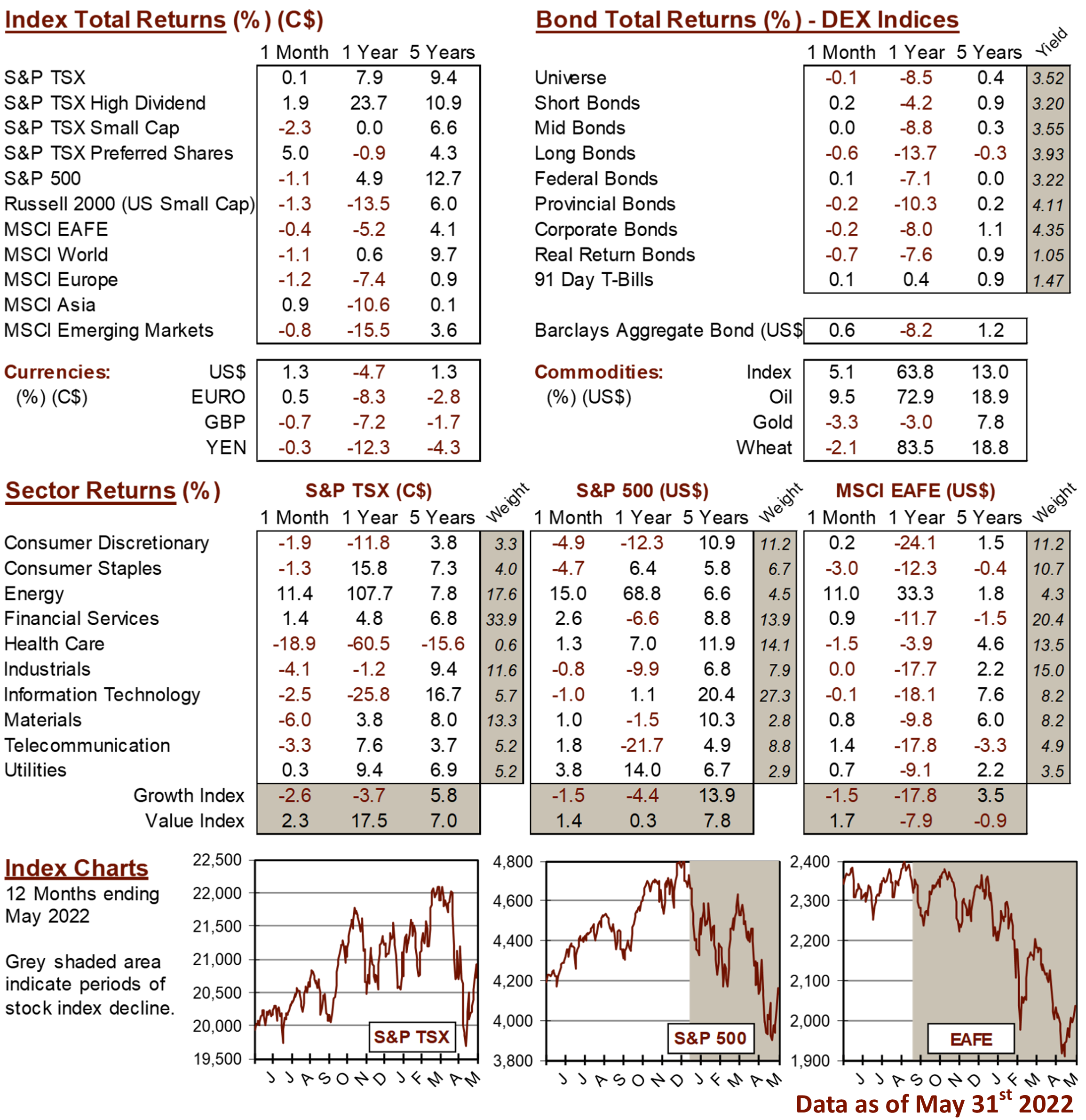

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4