Knowledge Centre

Finding Income

May 2017

It is very difficult for clients to earn a steady income these days while short-term interest rates hover near 60 year lows. Couple this with the fact that the average client has an aversion to investing in long term bonds because of the belief that higher interest rates are on the horizon, it becomes nearly impossible to earn much more than money market rates. So what are the options for those looking for good yields now while being able to take advantage of higher rates in the future?

With over $300 billion in assets, Guaranteed Investment Certificates (GICs) account for a huge share of fixed income sales in Canada. This is due to the advantages that many clients feel GICs offer over bonds: a predictable and guaranteed income stream, the principal value won't decline and no fees. For these benefits clients are subject to returns that can be low or capped. Additionally, GICs must be held for a set period so you are locking in your money for these low returns. If ashed early, there can be early withdrawal penalties. Some institutions do offer redeemable or cashable GICs at lower rates but the difference compared to a locked product can be significant.

Bonds have very different characteristics but offer distinct advantages if managed correctly. Interest rate changes affect bond prices so that as rates fall the price of bonds increase and as rates rise prices fall. However, if held to maturity, then bonds repay the full principal. Another essential difference is liquidity. Bonds can be bought or sold at any time at a price determined by each bond's individual characteristics and current market conditions. While bond returns are impacted by the cost of purchasing and managing the portfolio, this can be offset by the higher returns bonds can achieve. It is this possibility of higher yields and capital gains that favours

bonds as an alternative.

A bond ladder is a straightforward strategy for conservative investors. Capital is allocated into equal portions and invested across various maturities up to a set period. Prices should not be at a significant premium over par and as each bond matures, the proceeds are reinvested in a longer maturity. The idea is to free up funds each year to capitalize on any increases in interest rates, while protecting from reinvesting a large portion of the portfolio amid falling rates.This strategy also smooths out reinvestment risk since capital is being reinvested incrementally throughout a full interest rate cycle.

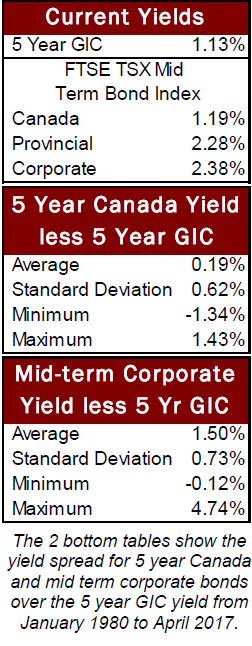

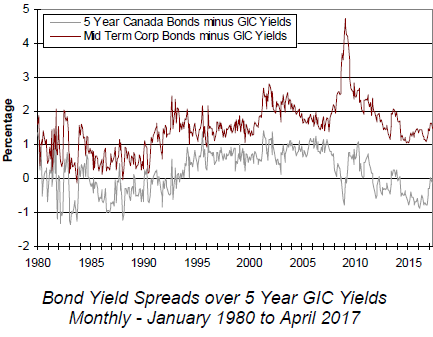

Given the current low interest rate environment this may be a good time to consider this strategy. Current 5 year GIC rates (based upon the average rates of the Schedule A chartered banks) are 1.13%, the lowest in 37 years! Building a laddered bond portfolio with high grade corporate bonds and some provincial issues will significantly increase yields even with fees. As the chart illustrates, while the advantages today are not as obvious as they were during the economic turmoil of 2008, they are still substantial. At that time, the yield spread (the difference between Mid Term Corporate bond yields and 5 year GICs yields) spiked to historic levels. Currently, clients are able to increase their portfolio yield by up to 1.50% over prevailing GIC rates. This may be just the average value added for this corporate bond strategy, but 133% more income makes a lot of sense.

It does not matter which way interest rates move going forward because a laddering strategy is able o generate consistent returns. Laddering bonds allows clients to balance the risk and return in their bond portfolio as shorter term bonds carry a high degree of stability and longer term bonds enhance overall yield. A further advantage is that clients can always use a maturing bond to fund a different investment type or sell bonds to cover unanticipated expenses.

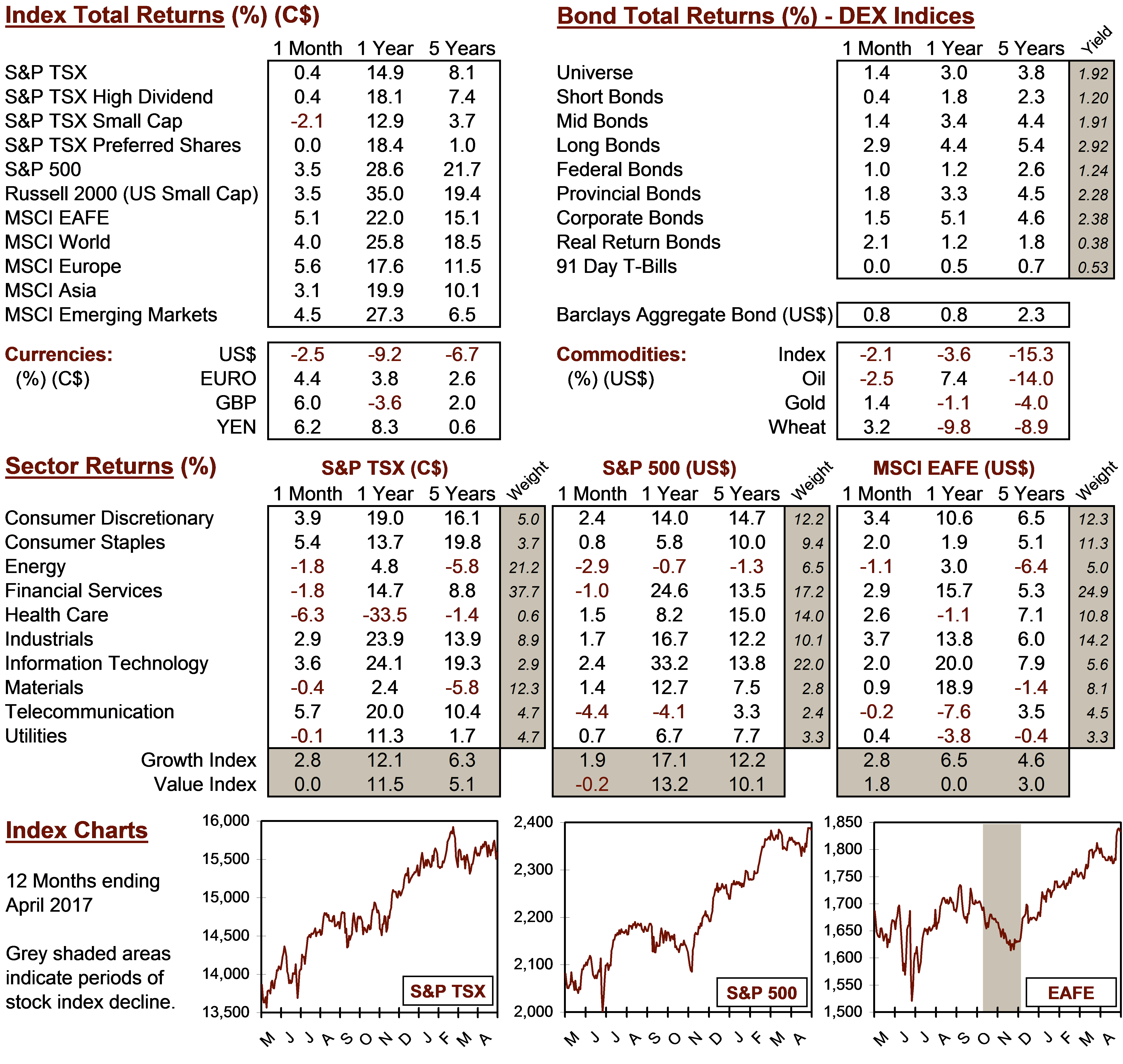

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4