Knowledge Centre

Finding Income

November 2023

Two years ago, short term interest rates were at 65 year lows which made it more difficult for fixed income investors to earn a decent income. Couple this with the fact that the average investor had an aversion to investing in long term bonds because of the belief that higher interest rates were on the horizon, and it was nearly impossible to earn much more than money market rates. So the options for clients looking for good yields while being able to take advantage of higher returns in the future were limited.

Guaranteed Investment Certificates (GICs) account for a huge share of fixed income sales in Canada with over $300 billion in assets. This is due to the advantages that many investors feel GICs offer over bonds: a predictable and guaranteed income stream, the principal value won’t decline, and no fees means that every penny earned is theirs to keep. For these benefits clients are subjected to returns that can be quite low. Once you factor in inflation and the erosion of purchasing power the returns for many years were actually negative. This is not a good situation especially as people are living longer. Sometimes the safety investors are seeking becomes just another form of risk.

After GICs, bonds are the next popular vehicle in adding returns to an investor’s portfolio. They have very different characteristics and do offer distinct advantages. Interest rate changes affect bond values so that as rates fall, bond prices increase and as rates rise, prices fall. However, if held to maturity bonds repay the full principal. Another essential difference is liquidity. Bonds can be bought or sold at any time with price determined by each bond’s individual characteristics and current market conditions. While bond returns are impacted by the cost of purchasing and managing the portfolio, this can be offset by the higher return’s bonds can achieve. They offer the distinct possibility of higher yields and capital gains.

Taking it one step further and incorporating other types of fixed income vehicles can be quite rewarding. For example, constructing an optimized High Yield Fixed Income portfolio consisting 15% of a 10 year Corporate Bond Ladder, 12.5% Canadian REITs, 15% High Yield Bonds, 12.5% High Yield ETFs, 25% Mortgages and 20.0% Fixed Income Hedge Funds leads to a very attractive alternative. Certainly, the degree of risk investors assume with this type of portfolio is higher but so is the potential for greater returns. The real question is, is it worth it?

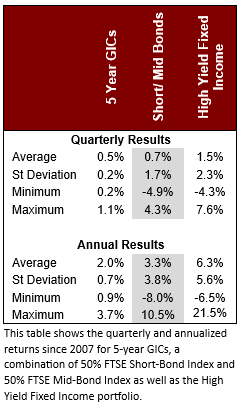

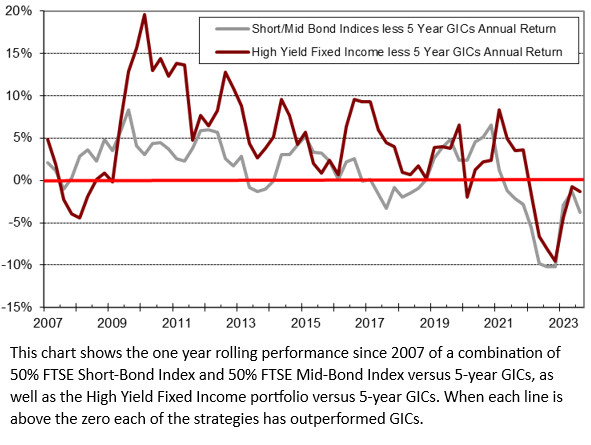

Given the current surge in interest rates due to the Bank of Canada’s assault on inflation, this is a good time to consider the short and long term merits of each strategy. Currently, 5 year GIC rates (based upon the average rates of the Schedule A Chartered Banks) is 4.4%. Using bonds with a similar term structure (represented by 50% FTSE Short-Bond Index and 50% FTSE Mid-Bond Index currently yielding 5.0%) shows how an all bond portfolio would perform. At the same time, the returns shown for the High Yield Fixed Income portfolio indicate that it may be the best option. As the chart shows, over the past 16 years the one year rolling performance of these two portfolios consistently produce higher returns when compared to 5 year GICs (outperforming 67.2% and 80.6% of the time, respectively). The data to the left shows these advantages both on a quarterly and annual basis while doing so with a very low correlation to GICs of 0.16 and -0.12% respectively. Obviously, there have been two distinct periods of material superiority for GICs (2007-2008 and 2022-2023) but once interest rate hikes end and start to retreat GICs brief time in the sun is dwarfed by the alternative strategies returns.

With today’s elevated yields and continued interest rates increases, investor returns on GICs after inflation and taxes will likely underperform. Unless investors are comfortable with only safe harbour investments and unconcerned with the less than stellar returns going forward once interest rates (and therefore GIC rates) begin to retreat, the only realistic solution is to explore other options. The decision to be safe is paradoxically making many investors less safe and creating a whole new level of risk in terms of running out of money. With this situation bearing down on many investors, the proposed High Yield Fixed Income structure is a solution that plays it safe, but still generates meaningful returns.

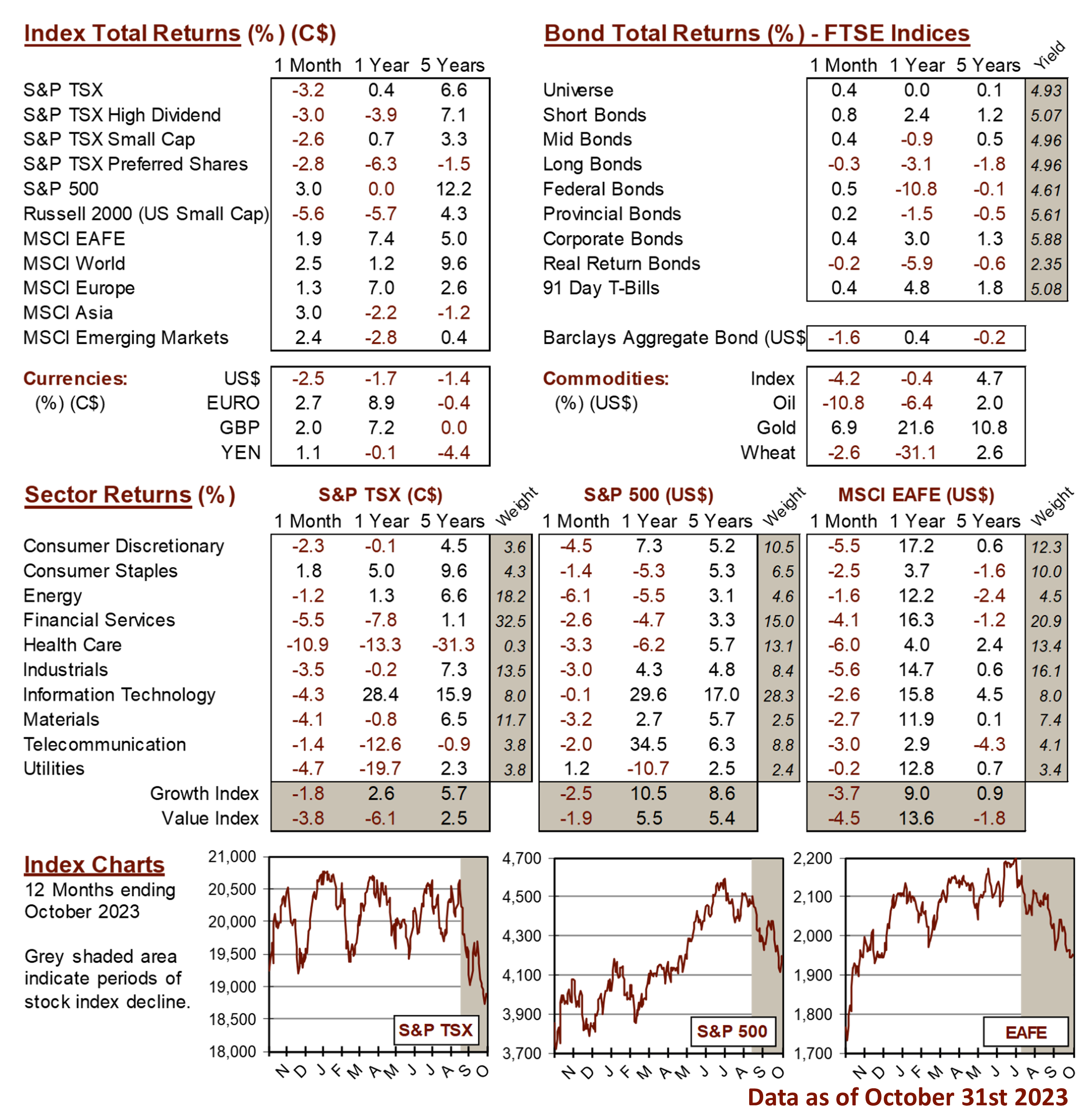

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4