Knowledge Centre

Is Passive Now Passé?

December 2016

Time after time the story seems to be the same, active investment management on average does not beat its benchmark. This is generally true, especially in instances where the impact of fees is severe or a host of other reasons that have been well documented. However, leaving the issue of fees aside for the moment, active management success comes down to the skill of the investment manager, and like most things, superior performance comes in waves or cycles. Right now it appears Canada is entering a new cycle where larger than normal numbers of active managers are adding value beyond their benchmarks.

The tide appears to be turning for active managers, as volatility has crept back into the stock market. Since the global financial crisis of 2008 many active managers have been hard hit, because volatility has been low and the dispersion of returns from one stock to the next has been very narrow, reducing the opportunity to isolate winning stocks and increasing the likelihood of poor relative performance.

Now however, there is a lot of uncertainty as to how the economy, monetary policies and fiscal policies will evolve as it appears we are coming into a different era. While there is not yet a tidal wave of movement toward active management, there is definitely an early sense that investors are becoming more open to the idea. Given that the dispersion amongst Canadian stocks is close to its highest levels since the crisis, the case for performance opportunities is allowing active managers to set themselves apart from passive strategies.

History shows this is exactly what happens. Active investment managers tend to hold more equal weighted portfolios than the market cap weighted indices, such as the S&P/TSX Composite Index. So there is a structural advantage for managers to outperform when the equal weighted stock index outperforms its cap weighted index sibling. Since 2008, when the equal weighted S&P/TSX index has outperformed or underperformed the cap weighted version on a quarterly basis; the median active Canadian equity manager has produced winning or losing relative performance which matched the benchmark's results 84% of the time. Or in other word, when the equally weighted index outperformed then so did investment managers and vice-a-versa. These results closely match the 86% correlation experience by U.S. stocks since 1980.

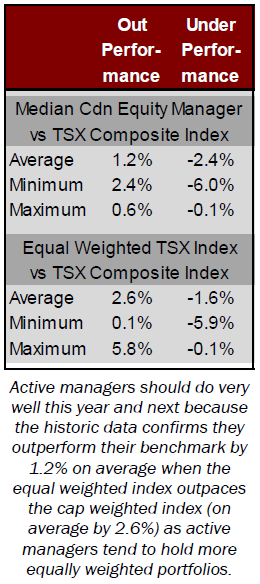

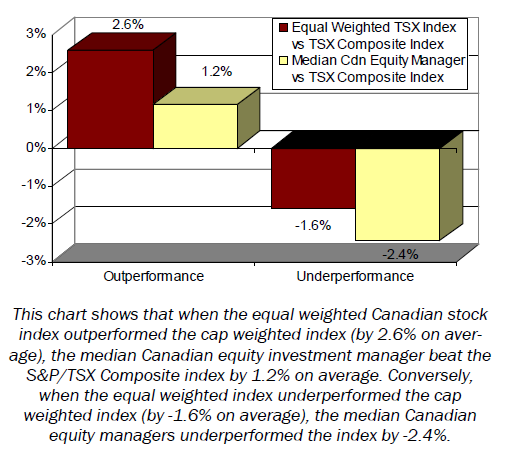

The chart above and the data to the left shows that when the equal weighted Canadian stock index outperforms the cap weighted Canadian stock index (by 2.6% on average), the median Canadian equity investment manager beats the S&P/TSX Composite index by 1.2% on average. So this means that more than 50% of Canadian equity managers beat their benchmark before fees. Conversely, when the equal weighted Canadian stock index underperforms the cap weighted index (by -1.6% on average), the median Canadian equity investment managers undershoots the S&P/TSX Composite index by -2.4% on average.

If history does repeat itself, then active managers should do very well this year and next, since the equal weighted index is outpacing the cap weighted index by 6.51% (25.6% versus 19.1%) year to date. It is little wonder that there is heightened interest in active stock picking as recent events are creating an environment that gives skill a chance to shine. While passive investing is never going to be truly passé, active management will always have its place in investors' portfolios if it is done correctly.

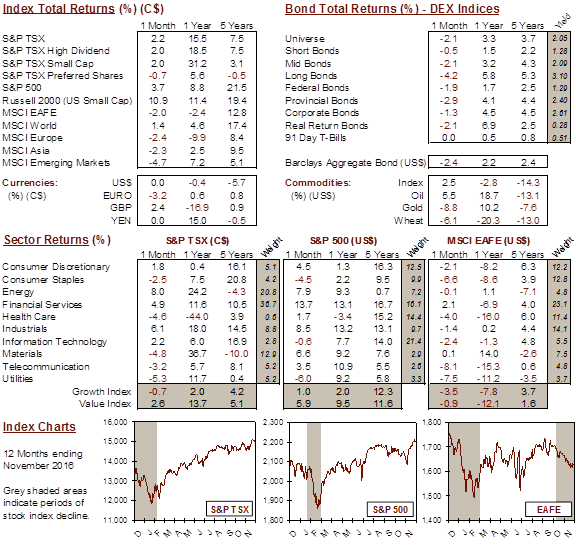

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4