Knowledge Centre

On The Way Up, Again

March 2019

Many investors were all too willing to bail on stocks recently as their prospects looked quite dim. Of course, the same was being said of the market in early 2009 when the world was thought to be on the edge of financial ruin. The reality was that the first part of 2009 may turn out to have been one of the best times to buy equities in a lifetime. While the current conditions will not likely turn out to be such a dramatic windfall, they do not justify the abject contempt hurled in the direction of equities. Unless financial Armageddon lurks around the corner, the recent growth in prices looks sustainable.

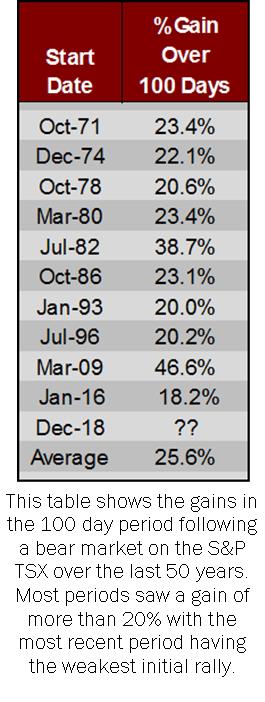

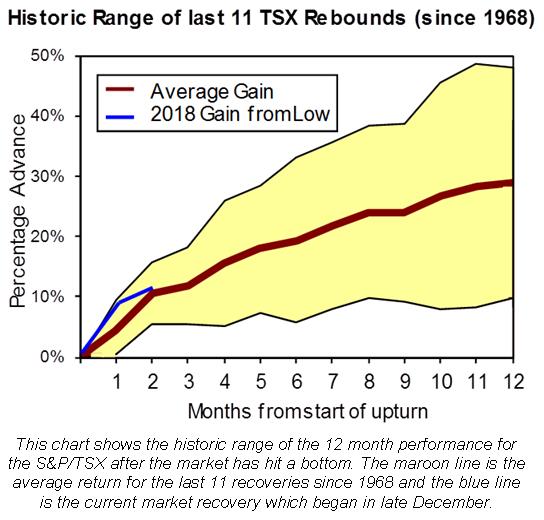

The just-beginning recovery from the last short bear market (ending December 24, 2018) has in reality been simply average when compared to other rebounds over the last 50 years. The chart below shows the historic range of the 12 month performance for the S&P/TSX after the market has hit a bottom. The maroon line is the average return for the last 11 recoveries since 1968. The blue line is the current market recovery which is entering only its third month and has closely tracked the average historic upturn. The data to the left shows how each of the recoveries has fared over the first 100 trading days since the market low. The average recovery after the last 11 bear markets has averaged about 25.6% at the 100 day mark. The current rebound is only 50 days in; but it is already up 16.6%.

The current bull market has roughly matched past initial recoveries, which perhaps reinforces the notion that it is hard to find many investors who love a new bull market. Generally, new bull markets have a knack of keeping investors on the sidelines. In theory it seems easy to climb onboard when prices are cheap, yet the reality of having the discipline to step into a new bull market is every bit as difficult as avoiding the devastation of a bear market.

Memories of 2008 are unfortunately still painfully fresh despite the fact that the last 10 years have generated stable and consistent returns. Back then, fears were rampant and investors were on the verge of panic. A big problem is that a bull market normally moves higher ahead of declining fears. By the time an investor feels that a bear market bottom is in place, the market has already rallied too far for the investor to feel comfortable stepping in. The old fear is replaced by a new fear of buying into a bear market rally. Consequently, many investors find themselves doing nothing as the market moves progressively higher.

Nobody recognizes bull market because memories of prior bull markets have faded (even if they were recent) and the media’s short term focus does not help the average person’s short term memory. Many investors are unimpressed by this recovery because so many bailed out in 2008 and only started to drift back into stocks as last years volatility kicked into high gear. So, thinking the boom is over can be understood. Investors believed the talking heads’ hyper-negativity on the economy and continue to believe the doomsayers’ claims that this is nothing more than a bear market rally. As the market rallies, discouraged investors trapped on the sidelines seek out kindred investors and experts that agree with them, which may make them feel better but does nothing for their portfolio.

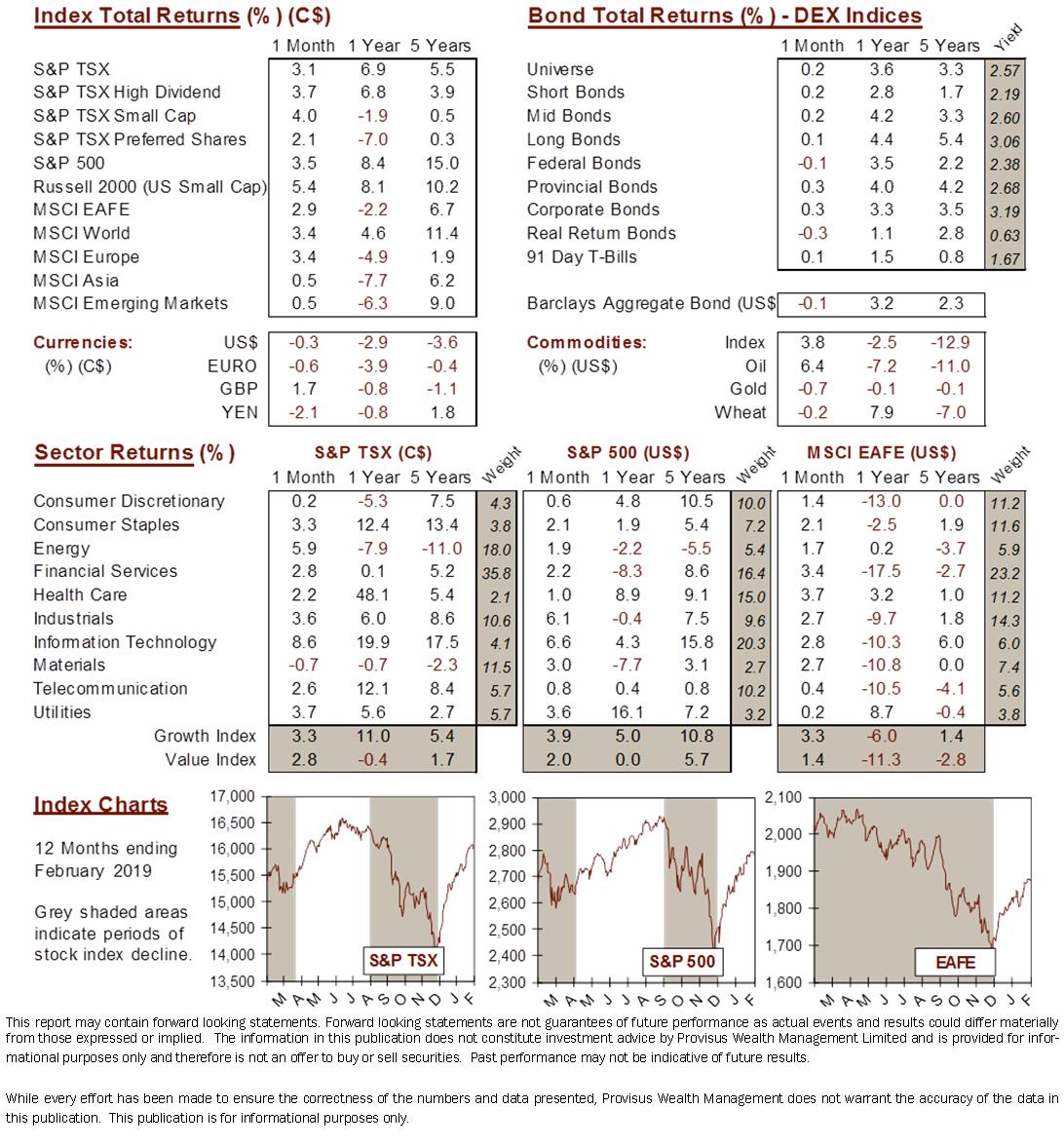

Investors do not love this market despite the year-to-date gains for the S&P/TSX at 12.2%, one of the highest amongst developed markets. What separates seasoned investors from the masses is discipline and the ability to invest without allowing emotion to override judgment. From a long term perspective, this could be a very solid bull market if we just forget all the so-called reasons for not loving it.

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4