Knowledge Centre

Presidential Election Changes

October 2024

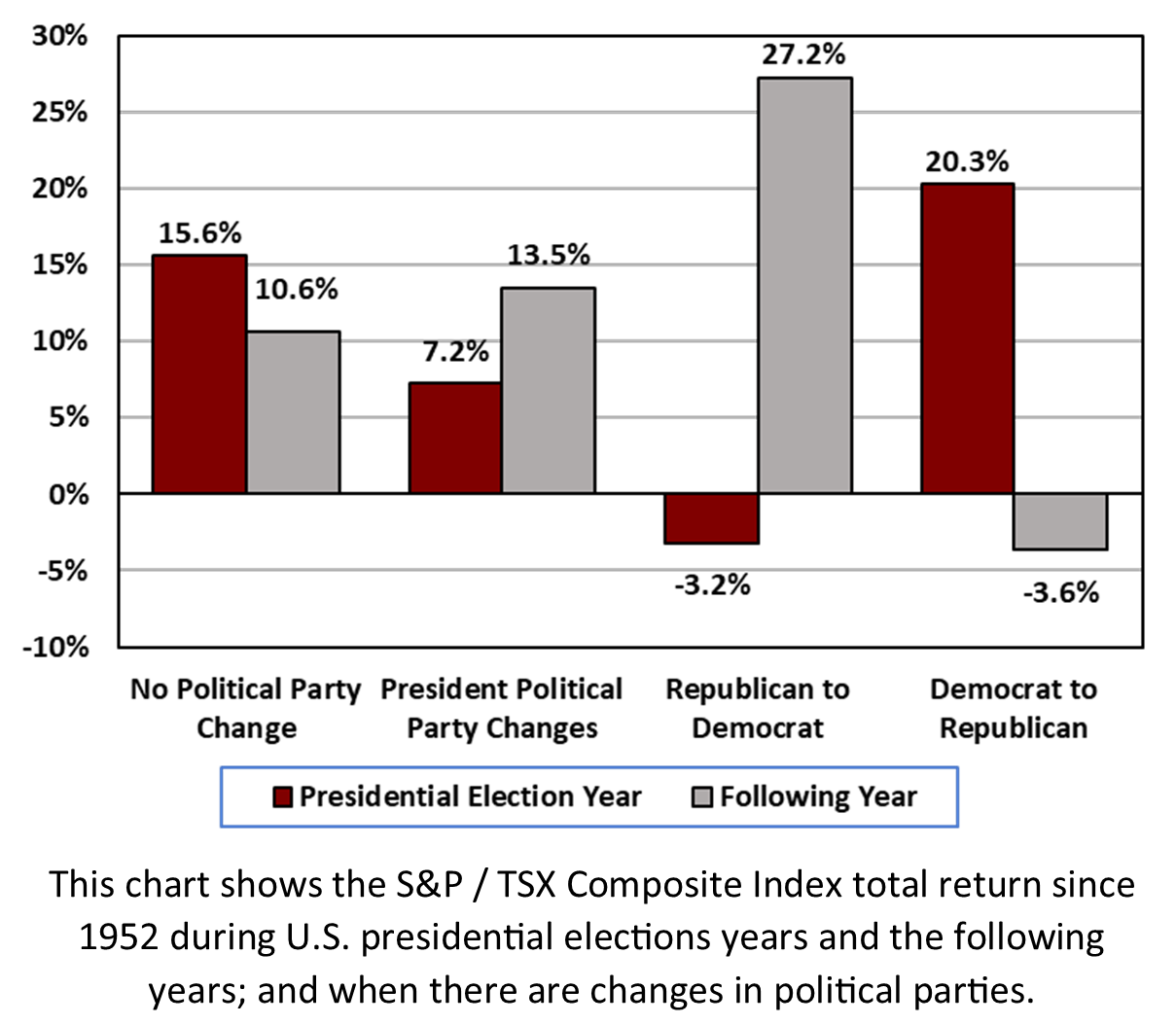

Historically, regardless of which political party was holding the U.S. presidency, there has been no significant difference for the performance of the stock market. As all investors know, predicting what will happen in the stock market is virtually impossible. Still, it is interesting to scrutinize historical data and see what trends emerge. For example, the S&P / TSX Composite Index during the 18 election years since 1952 has had only three negative years. The most profitable year of a presidential cycle has been the third year (2023 falls into this category). Interestingly, there appears to be a significant difference in performance depending upon which political party wins the presidency from the other party in the year of an election versus the following year.

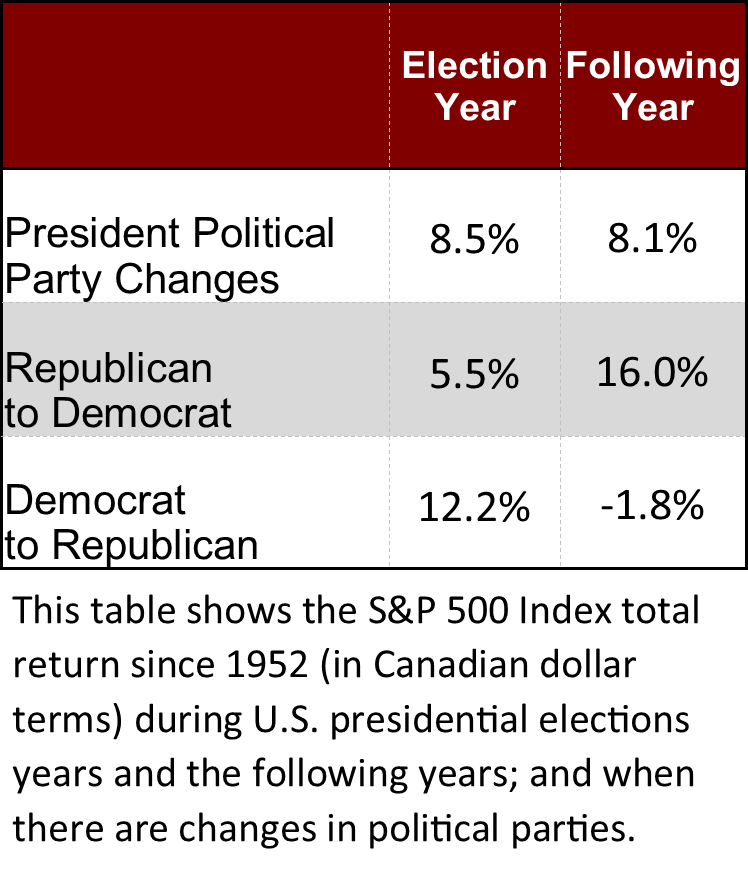

During the years when there is a presidential election going back to 1952, the S&P/TSX Total Return index has been in the positive 83% of the time (15 out of 18 years). The average return during each of the 18 election years was 11.2%, which is basically identical to the 11.3% gain for the index during all 69 years. The chart to the right shows how the Canadian stock markets have performed in various scenarios while the table to the left shows exactly the same set of data while using the S&P 500 Total Return stock index returns (in Canadian dollar terms).

On average, the S&P / TSX Total Return index increased in value by 13.5% in the first post election year when the political party of the United States’ President transitioned from one party to another. The year during an election before the transition occurred the Canadian stock market gained 7.2%. However, this included the 33.0% loss in 2008 during the Democratic Obama transition due to the stock market crash. When the incumbent party held onto power the return in the first post election year was 10.6%; and 15.6% during the year of the election.

It is interesting to look at what happens in the first post election year when the political party of the President shifted from a Republican to a Democrat. The S&P / TSX Total Return index was positive during the first post-election year with the average price increase equaling 27.2%. However, in the election year itself the market lost 3.2%.

When a Republican was elected President, the average return in the first year after the change amounted to -3.6%. Keep in mind that this represents a stark contrast to the price change for the S&P / TSX Total Return index during the election year with a mammoth 20.3% average annual returns. This data would tend to contradict the stereotypical line of thinking is that Republicans are "better for the markets" because they tend to push for more pro-business policies (i.e. lower taxes and less regulation).

Of course, both good and bad stock market performance in the year before or after an U.S. presidential election likely has less to do with the president's party and more to do with what was going on in the economy. Therefore, the problem with investing based on such data patterns is that it is not a good way to go about making investment decisions. While it might be exciting, there are no guarantees as there are too many other forces that alter market conditions.

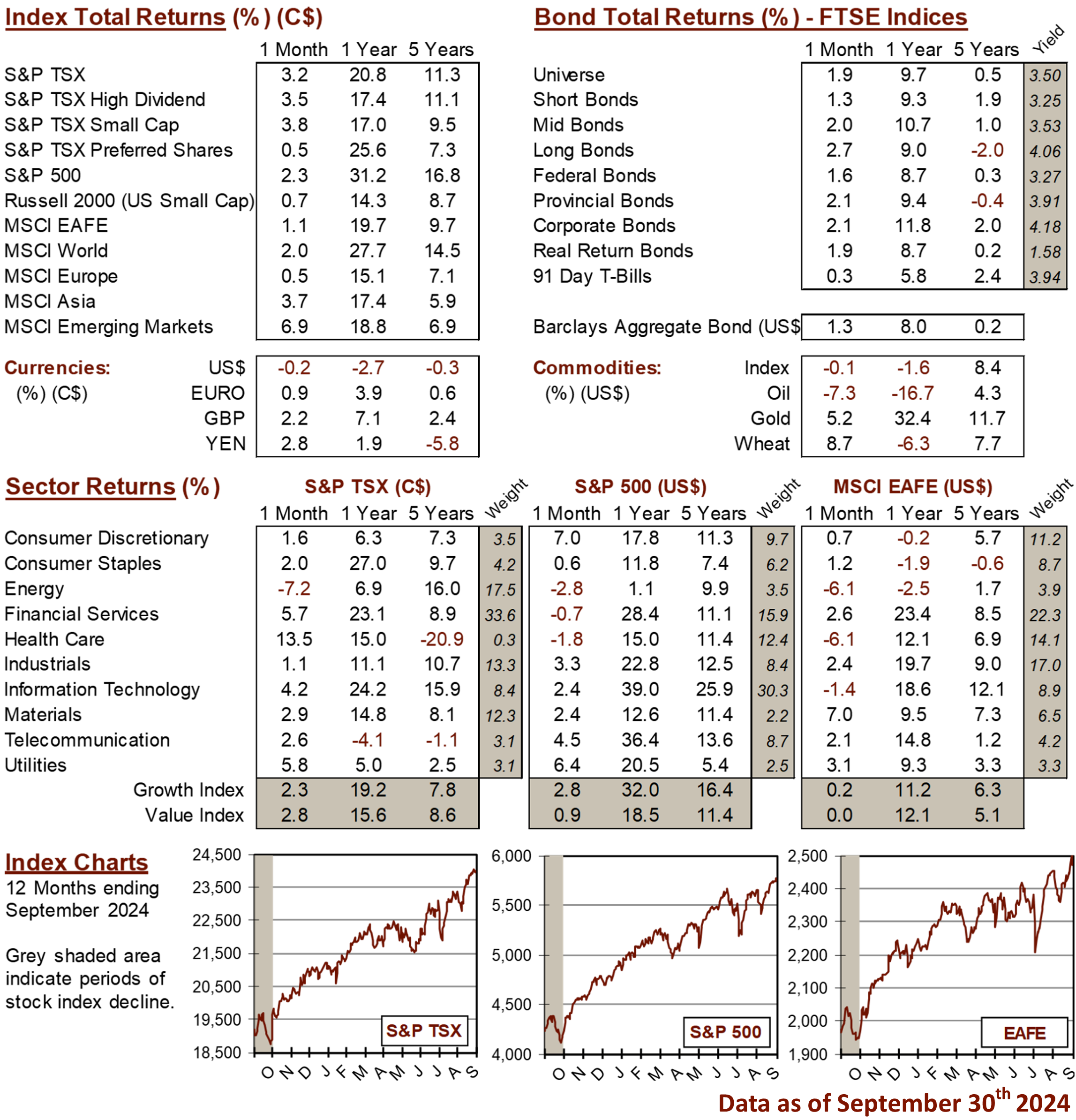

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4