Knowledge Centre

Pushing on a String

September 2016

For some, desperate times will lead to desperate and somewhat speculative measures. After years of low interest rates have led to limited success in achieving meaningful economic growth, more central banks have recognized that this mechanism is not working. So whether it is insanity, impotence or desperation, a growing number of countries have slashed interest rates to below zero.

Interest rate policy is effective in cooling down an economy, but much less potent when the economy is weak and rates are already low. An economy can be pulled back from a high growth trajectory as if it is tied to a string; but you cannot push it forward significantly once the weapon of choice has been exhausted. Interest rate cuts do not necessarily induce banks to lend or to pass on lower rates to customers.

Historically, low interest rates would be highly inflationary; however with oil prices falling and global economic growth slowing, inflation is not a concern...yet. Interest rates are very important to savers and pensioners and they are being penalized. There are numerous long term consequences of zero interest rate policies: investors come under pressure to take on excessive risk which leads to investment errors; investors may take on more debt since it is cheap to do so; people may spend more and save less as fiscal discipline declines which will make the creation of wealth more difficult; and finally it can have a profoundly negative impact on currencies.

Whether the European Central Bank cuts rates below zero to reinvigorate the economy, Switzerland slashes rates below zero to slow the climb of its currency, or the unprecedented move by the Danish, Germans and Japanese to charge clients to park their money in commercial banks succeed is open to question. After all, people can bring their money home and stash it under the mattress. Then what will happen to all those banks' glorious profits?

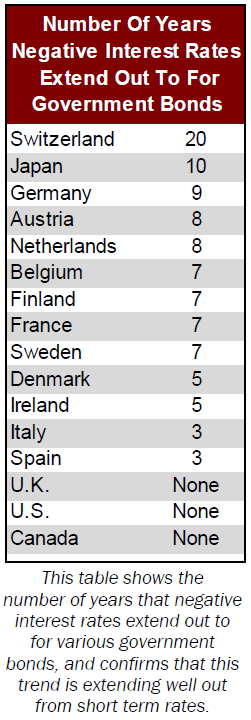

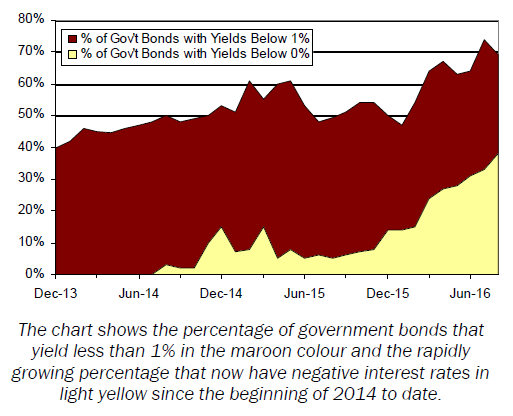

As the chart to the right and the data to the left show, low interest rates and zero interest rates in particular are growing trends. At the beginning of 2014, 40% of all government bonds offered less than 1% interest. Since then it has grown to 70% of all government bonds in circulation. Beginning midway through 2014, yields on government bonds started drifting into negative territory and today, 38% of government bonds have negative yields. Negative interest rates are now widespread and extend well beyond short-term bonds in many countries. As the table illustrates, even traditionally weaker nations such as Italy and Spain are getting into the game, but certain other countries are noticeable in their absence as the table to the left illustrates...for now.

The one good thing about zero rates is they reduce debtor's interest expenses because borrowing costs are so low and the interest payment burden becomes essentially zero. But all in all, negative interest rates are not spurring economic growth. Unfortunately history shows how ineffective rate cuts are when widespread deleveraging occurs.

Zero interest rates are bad news since they are incompatible with a vibrant, growing economy. The only reason that central banks have been able to push rates so low is because growth and inflation are low. For an increasing number of investors who need a steady cash flow, the temptation is to start looking in dangerous places for that income. That will be the really bad news.

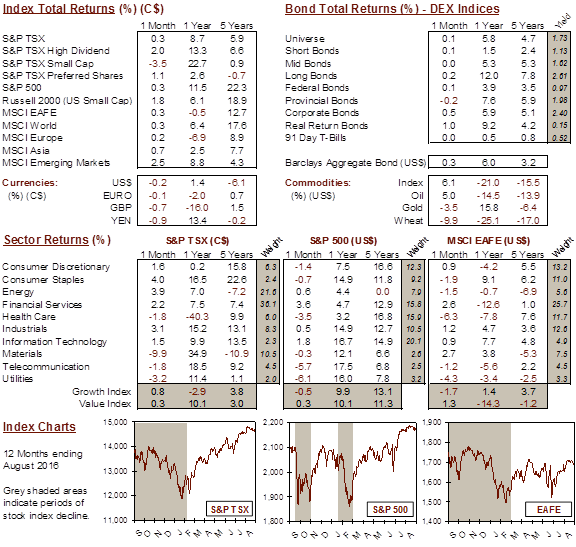

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

18 King St. East Suite 303

Toronto, ON

M5C 1C4