Knowledge Centre

REITs vs Interest Rates

September 2023

The prevailing line of thinking in the investment world is that rising interest rates will spell doom for Real Estate Income Trusts (REITs). Historically, the opposite has happened. The truth is that in periods of increasing short term interest rates REITs have performed extremely well. In most instances REITs should do as well as or better than common stocks.

REITs were once considered to be simply a portfolio add-on but now the case can be made that they are becoming a fundamental ingredient to sound portfolio construction. Non-traditional investments such as REITs have become a common solution as investors look for securities that have little correlation to stocks. The increased diversification that REITs offer without adding greater risk relative to stocks is certainly very enticing. As well, in prior low yield environments investors have been able to overcome ingrained biases and latch onto higher income producing securities.

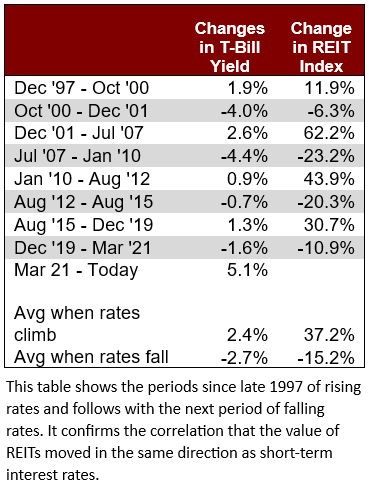

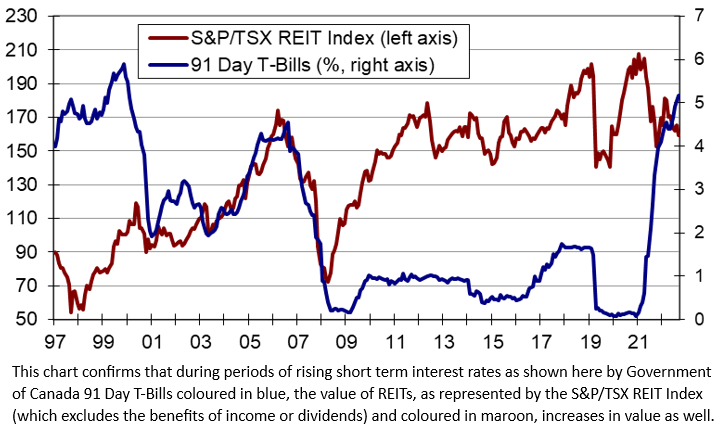

As the chart to the right and data to the left show, when short term interest rates (Government of Canada 91 Day T-Bills) rise the value of the S&P/TSX REIT Index (excluding the benefits of income or dividends) actually increases. The opposite is also true as falling interest rates are normally very detrimental to the value of REITs. This historic trend is obvious. While changes in interest rates may not be the dominant driver of REIT prices, recessionary risk and credit risk most certainly are. It was these two forces that were directly responsible for the most significant drop in REIT prices in 2008 and 2015. Recessions mean that tenants are less likely to occupy properties and/or could be unable to pay higher rents which weaken the value of real estate. A decrease in credit quality could stop REITs from refinancing debt or force them to pay higher interest rates.

Clearly, one of the largest expenses for real estate companies is interest payments since approximately 50% of their capital structure is debt, but normally only 10% of the debt needs to be refinanced in any given year. As such, short term movements in interest rates are not particularly detrimental to the underlying business. Additionally, increased interest rates are an excellent justification for charging higher renewal rates to renters and generating higher revenue. Normally increasing interest rates are detrimental to a strong economy, but an improving economic environment also leads to increased operating income from higher rents and greater occupancy rates.

Certainly, rising interest rates will have an impact on the value of real estate and eventually lead to increased volatility. The steady income that REITs generate, which has averaged 6.0% per year for the last 25 years, is in addition to any changes in price. The compounding of monthly income which normally accounts for 55% of the average REIT’s total return of 10.7% per year will, over time, go a long way to smoothing any negative impact of interest rate movements.

Timing is always difficult. REITs have struggled the past few years because of weak economic growth and a remarkably rapid increase in interest rates that sent shivers through the property market. As a result, publicly listed REITs are now trading, on average, at a 25% to 30% discount to their Net Asset Value. However, with inflation finally subsiding and central banks starting to tap the brakes on further interest rate hikes, investors are likely going to begin turning their attention to REITs as they have in the past to the significant benefit of patient investors who have not buckled under the volatility.

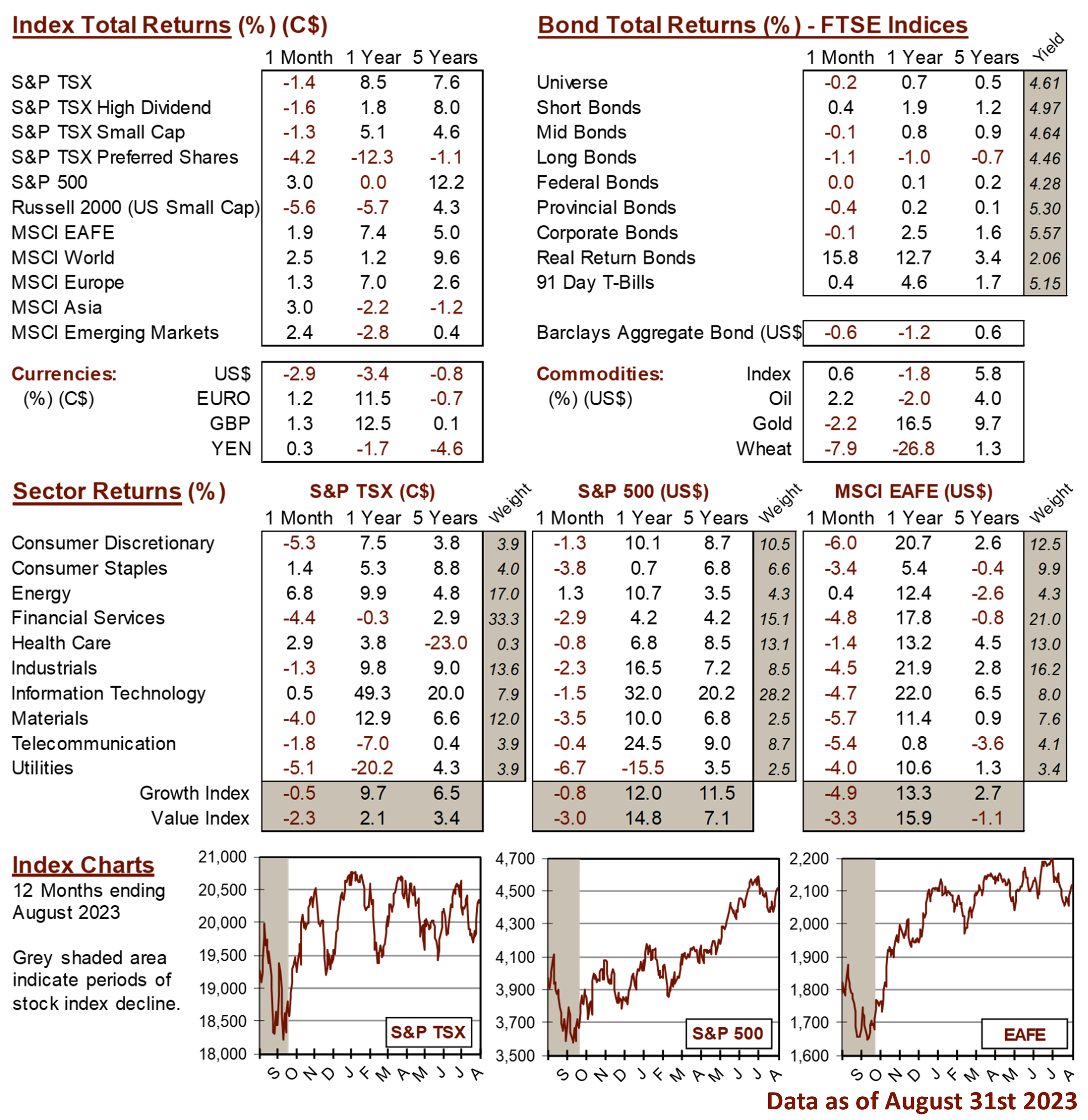

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4