Knowledge Centre

Stock Sectors After Rate Hikes

March 2018

Last year the Bank of Canada (BOC) implemented its first interest rate hike since 2010 and many investors reached for their crystal balls to try and forecast the future. While rising rates tend to signal stronger economic conditions and inflationary pressures, they can also have a meaningful impact on stock market sector returns. Changing the overnight interest rate, which is the cost that depository institutions pay to borrow money, is how the BOC attempts to control inflation. When the BOC increases the overnight rate, it does not directly affect the stock market but it does have a ripple effect that can rock the market. However some sectors benefit from interest rate hikes and others do not.

A review of equity performance following previous BOC tightening cycles over the past 20 years shows that in five of the past six periods of hiking overnight interest rates; October 1997, November 1999, May 2002, October 2004 and June 2010 (July 2017 excluded), there was some deviation from normal results which provided excellent opportunities but there are grounds for concern. The conventional way of thinking is that cyclical sectors like Industrials, Materials, Energy, Information Technology and Financials do well in a rising interest rate environment. A healthy economy has more investment activity, increased profit margins for financial entities, improved employment and a healthy housing market; all of which allow consumers to splurge. Meanwhile, defensive sectors like Utilities, Telecom, Consumer Staples and Healthcare (which tend to be proxies for bonds and do poorly as interest rates climb) generally show weaker results when the world's central banks take away the cookie jar.

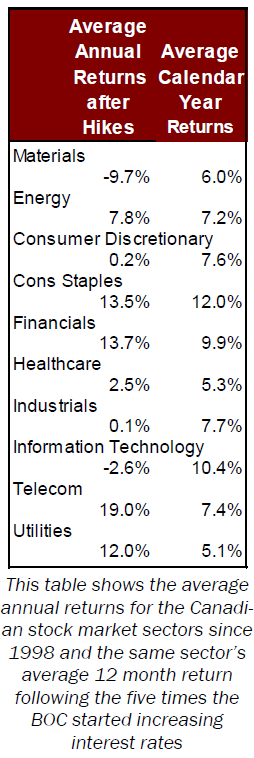

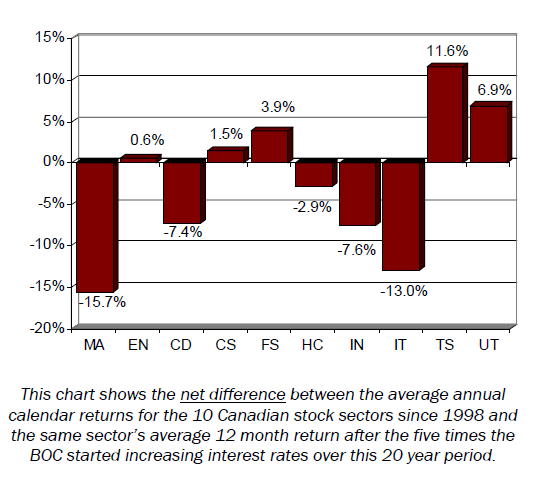

At times Canada dances to a different beat and over the past 20 years our stocks have for the most part have done the opposite of what economic theory would forecast. Perhaps it is a weak Canadian dollar, the near term glut in crude oil or weak commodity prices, but whatever the cause, the unexpected has occurred. The chart on the right shows the net difference between the average annual calendar returns for the 10 Canadian stock sectors since 1998 relative to the average 12 month return for the same sectors after the BOC implemented its first rate hike. The data to the left shows the individual averages for both occurrences. These performance numbers do not include the impact of dividends. These five sectors: Energy; Consumer Staples; Financials; Telecom and Utilities, have outperformed their long term averages after interest rates started rising, leaving the other five; Materials, Consumer Discretionary, Health Care, Industrials and Information Technology lagging. The degree of variance in some cases is quite glaring and the reverse of what was expected.

While a rising interest rate environment may not be detrimental to equity market returns in general, historically there have been clear winners and losers. Canadian investors who invest in our very unique stock market have been doing things differently for quite some time as conventional wisdom (at least with regard to domestic rate hikes) is thrown out the window. Perhaps rather than focusing on our own situation, many Canadians may be overly fixated on what is happening elsewhere; say to the south of us perhaps.

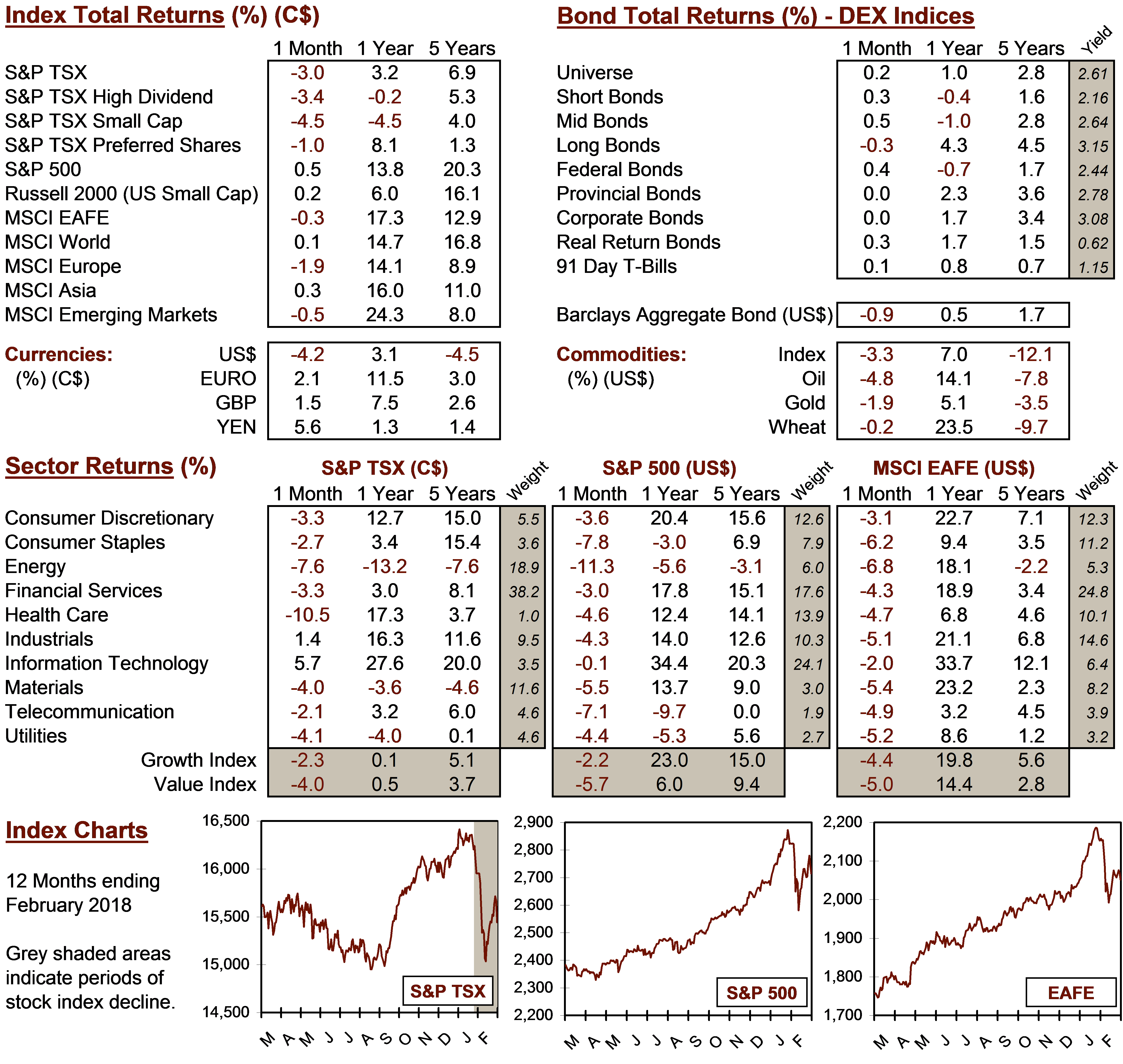

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4