Knowledge Centre

Too Little but Not Too Late

June 2024

As the global economy struggles to find its way, investors can benefit from a little perspective. Investing can be both painful and highly rewarding and investors can learn many lessons that will make them better investors in the future. Primary amongst them is the ability to take a moment to step away and see what is really happening, both the good and the bad to focus on the big picture.

Many investors were rattled by the start of the COVID-19 pandemic and the subsequent market selloff. The reality was that after the big initial fall, Canadian stocks actually closed the year up 5.6%. In almost all of the big market falls since 1951, rapid stock market declines came in the midst of an economic recovery and in most cases economic growth continued with the notable exception being the market collapse and recession following October 2008. Investors need not worry about whether a fall in the former predicts the likely outcome of the latter.

Normally during the last portion of a bear market most investors become risk averse, believing worse news is yet to come. They minimize or eliminate their equity exposure and move to the safety of cash and bonds. Eventually stock markets bottom and turn higher as improving economic news, such as increasing corporate profits, cause risk avoiders to eventually become risk takers.

Unfortunately, many risk avoiders will miss an entire stock bull market because of the ongoing noise of natural disasters, wars, asset bubbles, financial scandals, failing countries, currency wars and social unrest around the world. In reality the only way to obtain meaningful reward is to take on some level of risk.

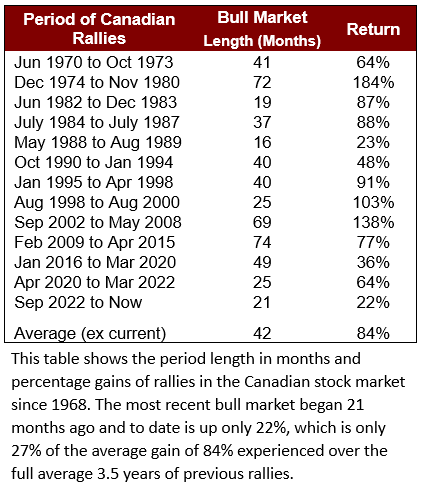

When equity markets fall, it is inevitable that comparisons to other market collapses in history are made. After a solid two year rally that saw Canadian markets climb more than 64% from April 2020, a correction would not be unexpected and did occur. Unfortunately, the recovery from the COVID-19 pandemic selloff was both shorter (which lasted 42 months on average) and weaker than the average 84% return for recovery since 1968. Therefore investors could feel some trepidation as to what would occur when the next rebound happens: outperformance, an average recovery or something else? Unfortunately, so far we are getting the “something else”.

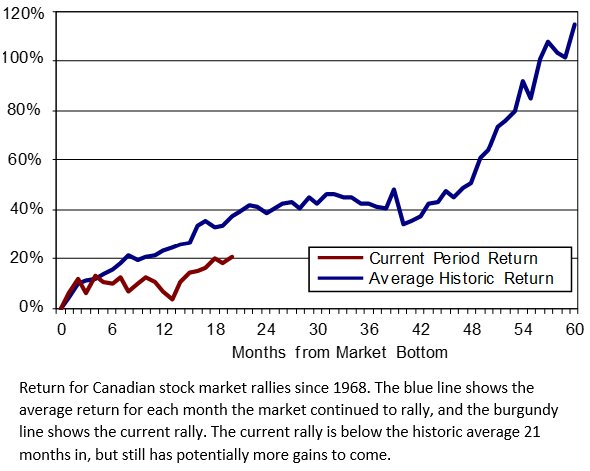

After the COVID-19 rally ended the Canadian stock market fell (-16.7%) between March 2022 and September 2022. The magnitude and velocity of the drop was not too extreme but set the stage for the current rebound. The problem is that the current global economic recovery has dragged on as interest rates surged and still linger at a decade high. The accompanying chart and data show that the current 21 month rally has trailed the historic average of the previous twelve rallies since 1968, with only a 22% gain so far. Four of the past twelve rebounds exceeded the average recovery time and generated more than 115% returns when the recovery was extended out to 60 months in length; the last year of this period effectively doubled the previous four years gain. So, hanging in is highly rewarding.

Looking forward, it is important to avoid overreacting. Now is not the time to panic or make financial decisions based on emotions. Think about your time horizon and if you have a longer perspective, then stay the course with your portfolio. Market uncertainty tests the resolve of even the most hardened investor, no matter their risk tolerance or time horizon. The current stunted recovery is disconcerting but it is important to maintain a balanced perspective as it can help investors remain focused during these mediocre times.

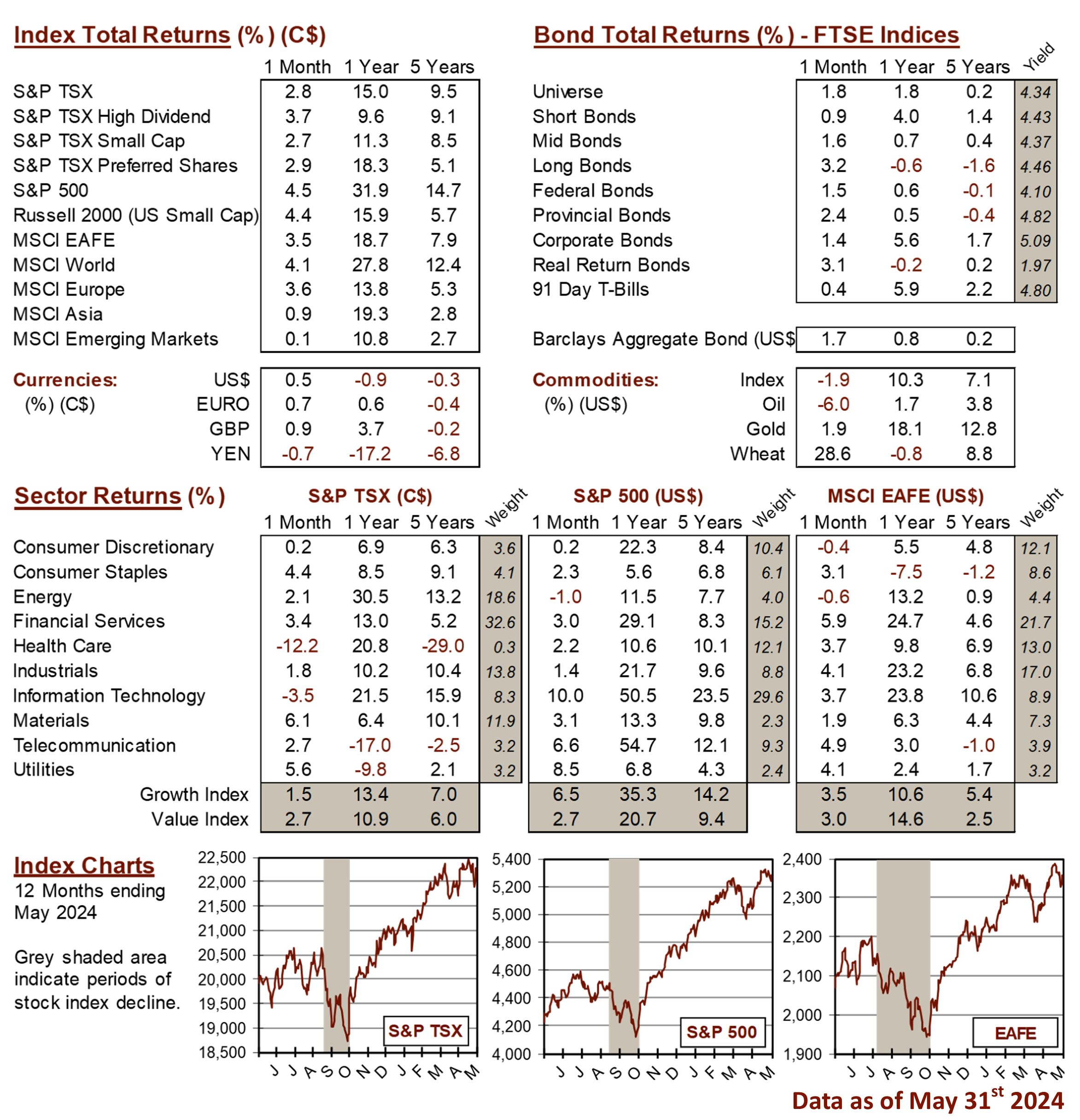

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4