Knowledge Centre

What Can Your “Benchmark” Press?

August 2024

For weightlifters this is a common question as it inquires the maximum weight they can lift. For investors the term benchmark is important as it indicates when investment performance meets a desired result. In both instances the objective is to reach a desired goal and then surpass it. What constitutes a “good” return depends on one’s needs and the type of investment one is willing to undertake, in terms of a long term goal such as retirement or a short term goal such as buying a house. Knowing how the benchmark is constructed will help investors attain what they are looking for in a good return.

A benchmark provides a starting point for constructing a portfolio and directs how it should be managed on an ongoing basis in terms of risk and return. The number of benchmarks is virtually endless and selecting the right one is not always easy. In most cases a benchmark tracks the performance of a broad asset class or a narrower slice of the market. Because an index tracks returns on a buy and hold basis, and makes no attempt to determine which securities are the most attractive, it represent a passive investment approach. With a benchmark one can see how much value was added and identify how it was achieved.

In Canada there are two dominant market capitalization weighted equity benchmarks that are used interchangeably and often in the same breath but they are in fact quite different. One is a subset, or an extension, of the other depending upon your point of view. The S&P/TSX Composite Index is the headline and broadest index for the Canadian equity market with approximately 95% coverage of Canadian equities. The other is the S&P/TSX 60 Index which covers about 79% of Canada’s equity market capitalization and addresses the needs of investors who require an index of the largest market capitalization segment of the market. It is also structured to reflect the sector weights of the S&P/TSX Composite.

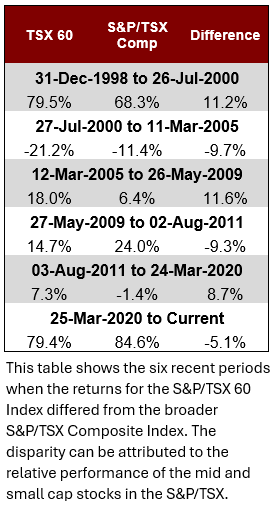

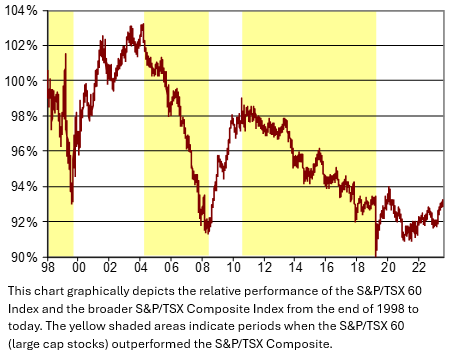

The S&P/TSX Composite is currently made up of 226 stocks with a total market capitalization of $3,475 billion or an average of $15.3 billion per company. All 60 stocks of the S&P/TSX 60 are in the S&P/TSX Composite and it has a total market capitalization of $2,754 billion or an average size of $45.9 billion. Even though the changes in daily valuations between the two indices since 1998 show that they have a correlation of 0.99, there are distinct periods of divergence between them. As the table to the left shows there have been six periods when one has outperformed the other. The yellow shaded areas in the chart to the right indicate periods when the S&P/TSX 60 (large cap stocks) outperformed the S&P/TSX Composite, which can be attributed to what they do not have in common. The residual 166 stocks have an average market capitalization of $4.3 billion (average size of $4.3 billion) or only 21% of the S&P/TSX Composite. The current period which began on March 24, 2020 - the beginning of the COVID-19 pandemic - indicates that the mid /small cap segment should outperform larger capitalization stocks for the foreseeable future.

Investors should be aware of the holdings in their own portfolio relative to either of these benchmarks in order to better understand why their portfolios may perform differently than expected. Investors who make an “apples to apples” comparison will be able to better weigh the underlying risks contained in the benchmark and how that applies to their own risk tolerance.

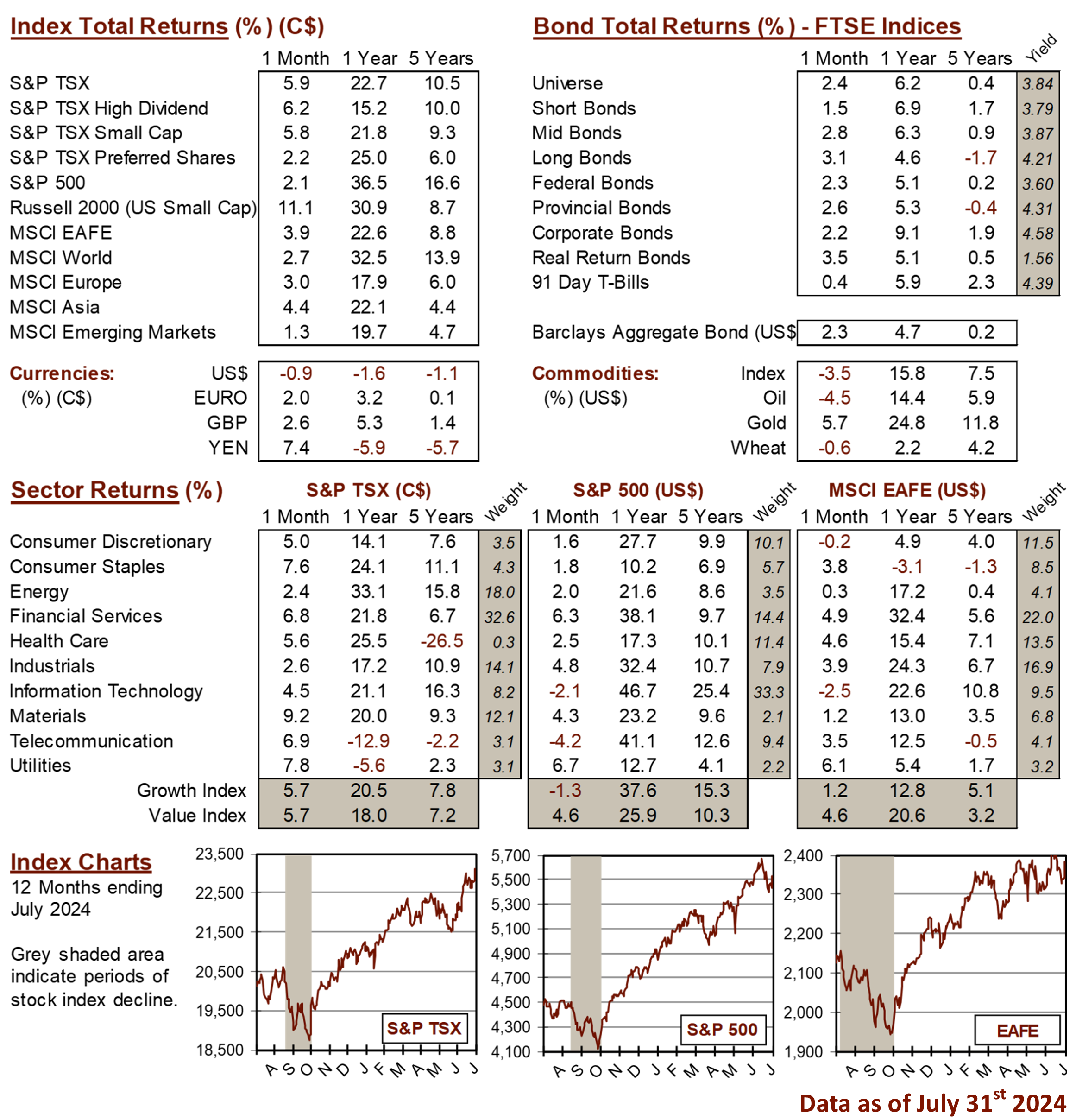

MARKET DATA

This report may contain forward looking statements. Forward looking statements are not guarantees of future performance as actual events and results could differ materially from those expressed or implied. The information in this publication does not constitute investment advice by Provisus Wealth Management Limited and is provided for informational purposes only and therefore is not an offer to buy or sell securities. Past performance may not be indicative of future results. While every effort has been made to ensure the correctness of the numbers and data presented, Provisus Wealth Management does not warrant the accuracy of the data in this publication. This publication is for informational purposes only.

Contact Us

"*" indicates required fields

18 King St. East Suite 303

Toronto, ON

M5C 1C4